Posted on November 11, 2021

By Paul Vanguard, for BullionMax.com

Okay, it's official: inflation, at 6.2% year-over-year, is out of control.

Almonty Industries CEO Lewis Black has some discouraging predictions…

Next year, you're really going to start to feel it. It will be a tough year. There is a whole generation that has never been in an inflationary environment. And I think it's going to be shocking. You're going to see inflation really getting its teeth, and you're going to start seeing a huge escalation of costs across the board.

That sweater unraveled fast. Remember, the Federal Reserve has a goal of a 2% inflation rate (for unspecified reasons). Then, post-pandemic, they cited the years they'd failed to hit that 2% goal just right and decided to let inflation fluctuate over 2%, basically making 2% a long-term average goal. That's another way of saying, "Yes inflation will go over 2% but don't freak out, we're still in control. It's all part of the plan."

In April, we saw 4% inflation. Transitory, right? Keep not worrying.

Then the last six months happened: 5%, 5.4%, 5.4%, 5.3% (whew!), 5.4% and finally October's stunning 6.2% That's a 30-year high.

Okay, sure, supply chain snarls. Fed Chairman Jerome Powell can say it's not his fault. (If only logistics were the issue, he'd be right. He seems to've conveniently forgotten that 25% of all dollars now in circulation were born in the last two years.) Milton Friedman put it best:

Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.

We can litigate causes and point fingers till the cows come home. And as tempting as that is, let's turn our attention to how to survive in this brave new world.

So to hear Black say we've yet to feel inflation's teeth, well, that's scary.

Unfortunately, we can tell he's right… Right now, the producer price index (PPI) that measures changes in raw materials and intermediate goods is seeing 20% inflation and those are price hikes we haven't even seen yet. Boy oh boy, when those prices hit the shelves, we're going to have a nationwide case of sticker shock.

So what's next? We've seen a number of movies with a similar opening scene… Is this Nixon? The one about the Weimar, where folks swapped their wallets for wheelbarrows? Venezuela, where they knocked six zeroes off the bolivar?

Black thinks we're in for a Nixon-Carter stagflation sequel. That's grim but definitely not as bad as it could be. Supply chain disruptions continue to wreak havoc, and nobody expects them to get better anytime soon (certainly not in time to save Christmas). Black draws our attention to Europe, where workers are demanding up to 15% increases on their salaries. The funny thing about that, when companies have to pay their workers more, they make up the difference by raising prices. And when they do get back to work, everything they touch will be made from commodities and intermediate inputs that are 15% pricier at least.

Saying that the U.S. government passed a $1.75 trillion infrastructure bill in this environment sounds like a joke. Spoiler alert: It's not a joke. The only real argument to make this move was to fix today's supply chain issues with, typical political thinking, a 10-year plan. On the other hand, there are about 1.75 trillion other reasons not to do this. Well, too late this time.

What do you think all that additional government spending will do to the economy?

Black expects the bill to make inflation worse, of course, along with anyone who's ever read a single story in The Wall Street Journal. Well, how much worse, and do we even want to know?

There's one silver lining in the inflationary clouds boiling overhead (see what we did there?)

Whoever doubted that a commodity cycle is underway is probably going to change their minds. Steel, cement, copper, nickel, tungsten, and tin are some of the metals that Black advises investors snatch up.

These metals, along with many other commodities, have already seen their prices spike. Supply chains, remember?

And herein lies an opportunity: Gold, for the most part, hasn't moved over the last few months, even though it's the most accurate gauge of inflation. Silver's price has been lingering at levels so low that it has spawned a grassroots movement of stackers who accuse big banks and brokers of constant, relentless market manipulation to suppress silver's price.

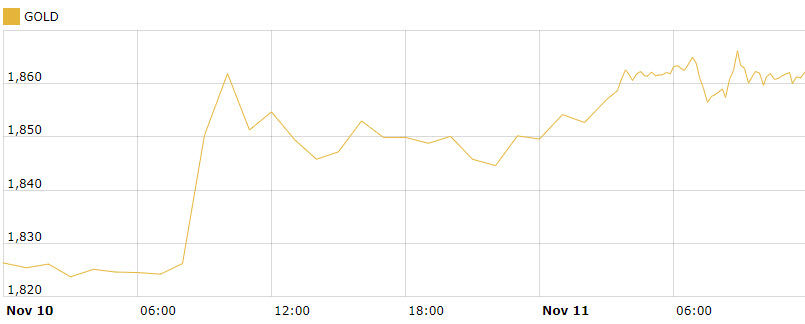

In fairness, gold did finally move. This last inflation report lit a fire under gold and drove it to a many-months high about $1,864 yesterday. It looked like this:

Compared to nearly every other commodity, gold isn't particularly volatile. Gold generally benefits from inflationary environments, like other commodities do. Gold's superpower, though, is it's countercyclical . That means it tends to go up when the economy's in the dumpster, and most other commodities plunge.

The best part? Gold's a lot easier to store than heaps and truckloads of steel and copper. It doesn't smell bad like crude oil. It doesn't rot like lumber, and it doesn't spoil like hard red winter wheat. Gold is maybe the only commodity you'd actually want to store in your home.

Look: I really hope inflation goes away by itself, the U.S. economy recovers like a phoenix from this recent unpleasantness and Glenn Frey comes back from the dead for an Eagles Hell Freezes Over Again tour. But I'm not going to buy tickets just yet.

Paul Vanguard is a lifelong precious metals enthusiast and a proud member of the BullionMax team.