Posted on March 10, 2022

By Paul Vanguard, for BullionMax.com

It is ever so rare to hear an official in the U.S. talk about gold. We have the largest central bank gold stockpile in the world, more than twice as much as the runner-up, four times as much as China. Even so, judging by policymaker statements and actions, you’d think the U.S. has no interest in gold bullion and doesn't own a single bar. If that’s the case, what’s the point of all that gold?

Former Federal Reserve Chair Ben Bernanke knows. In 2011, he said that he watches gold’s price as an indicator of economic strength, and people's faith in it. Specifically, he said:

Well, I pay attention to the price of gold, but I think it reflects a lot of things. It reflects global uncertainties. The reason people hold gold is as a protection against what we call tail risk, really, really bad outcomes. And to the extent that the last few years have made people more worried about the potential of a major crisis, then they have gold as a protection.

As we all know, markets operate in bull and bear cycles. (That’s expansion and contraction, or “up and down” for those of you who don’t read The Economist. A mnemonic to remember the difference: when attacking, bulls strike upward with their horns, while bears swipe downward with their paws – ergo, bull markets go upward, bear markets downward.) These market cycles are inevitable – they’ve been a feature of free-market capitalism since the invention of the first stock exchange in Amsterdam, way back in 1611.

These cycles can last from two to ten years. That’s a big reason a bear market in stocks generally translates into an economic recession (sometimes, multiple recessions, like the 1970s stagflation era).

This established historical pattern likely holds true even, or especially, today. Stocks are running on quantitative-easing fumes, and seem to’ve bounced off the ceiling.

The consensus seems to be that the U.S. economy is somewhere between its late-stage and the start of a recession. This consensus could be right, and it could be wrong. Regardless of whether a recession is weeks or months away, we should all expect to experience recessions during our lifetimes. That’s just common sense.

Now, the big question… How do gold and silver perform in a recessionary economic environment?

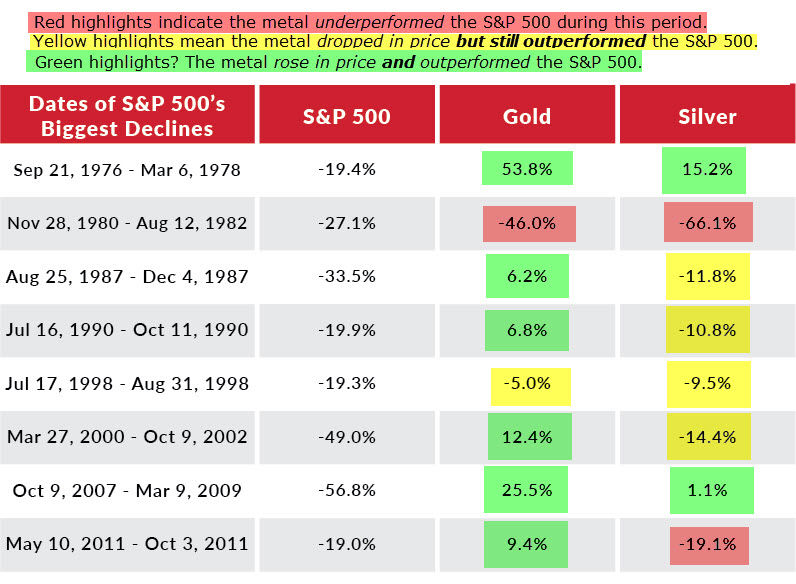

Here’s the answer at a glance…

Original research from our friends at Suisse Gold

In the eight recessions we examined since the U.S. dollar was untethered from gold, the metal underperformed in only two instances. The first came after a 2,300% price climb between 1970-1980. Even under economic duress, gains like these are going to make way for a selloff. The second was a one-month stretch between July and August of 1998.

Seems fair to say that gold underperformed in 25% of instances when the S&P 500 tanked, but not realistic. The 75%, the stretches where gold outperformed, are the relevant ones. For the closest historic episode to today, we have the intensely inflationary period between 1976 and 1978. The S&P 500 dropped 19.4%, and gold gained 53.8%.

When gold posts a new all-time high, you can bet that things are going haywire. Unsurprisingly, as the S&P 500 dropped by 56.8% between 2007 and 2009, gold gained 25.5%. And the $1,910 high thought long forgotten came as the S&P 500 dropped by 19% between May and October of 2011.

Silver's case is more complex and curious.

As you can see from the chart above, silver’s price ended down in all but two of these stretches.

However, note that despite price drops, silver outperformed stocks during six of these eight recessionary periods.

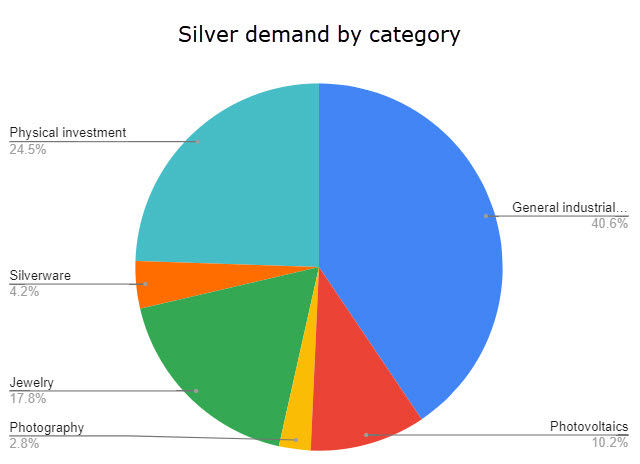

This is counterintuitive, to say the least. In order to understand what’s happening here, you have to consider silver's heavy demand from the manufacturing sector.

2021 data courtesy of The Silver Institute

During recessions, the economy weakens, manufacturing slows, and demand for basic materials (for example, copper) lessens. That explains why recessions are worse for silver than for gold.

But does anyone believe investors weren't piling into silver during any of these stretches as a safe haven investment? Not us – we sell way too much silver, and we actually talk to customers. We know that, regardless of industrial demand trends, folks load up on silver bullion when they think the economy is shaky.

That’s the historical perspective. What does that tell us about today?

And so we arrive to the current environment.

Gold generally has an inverse correlation with stocks. When both are going up, well, that’s confusing. Sometimes gold’s price is correlated with stocks during short periods, though the correlation breaks down and inverts over longer periods. (Play with the World Gold Council’s correlation tool to see this for yourself.)

Silver's performance during a recession is allegedly tied to whether precious metals are in their own bull cycle.

It's generally agreed that gold is in the middle of a bull cycle, one that normally lasts a decade. The key word here is “normally.” As Sir John Templeton reminds us, “The four most expensive words in the English language are, This time it’s different.”

Jim Rogers expects the next recession to be the worst he's seen, and remember he's seen all eight of the recessions in the table above. Gold outperformed stocks in seven of the eight recessionary periods we discussed, and silver outperformed stocks in six of them. Both gold and silver underperformed only once during those eight recessions.

So instead of asking ourselves how gold and silver will perform in the next recession, we think the right questions to ask are, “Do you own enough gold and silver to see you through the next recession?” If not, it's not too late to get started! Browse our product selection and buy gold bullion or silver bars right now.

Paul Vanguard is a lifelong precious metals enthusiast and a proud member of the BullionMax team.