Posted on July 05, 2022

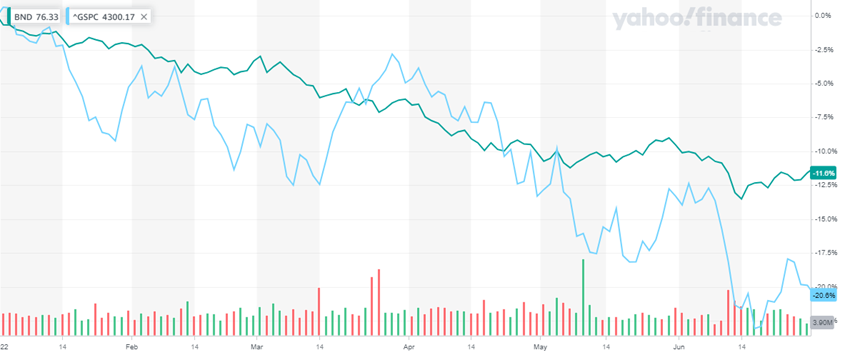

While those volatile stocks returned -20.6% putting the market officially into bear territory, the diversifying power of bonds (the yin to stocks' yang, the vanilla to the S&P500's chocolate) rode to the rescue by... handing you a -11.6% loss.

OUCH. What use is the standard-issue "conservative" 60/40 stock/bond portfolio when both sides are plunging? I mean, it looks like the end of Thelma & Louise to me!

While those volatile stocks returned -20.6% putting the market officially into bear territory, the diversifying power of bonds (the yin to stocks' yang, the vanilla to the S&P500's chocolate) rode to the rescue by... handing you a -11.6% loss.

OUCH. What use is the standard-issue "conservative" 60/40 stock/bond portfolio when both sides are plunging? I mean, it looks like the end of Thelma & Louise to me!

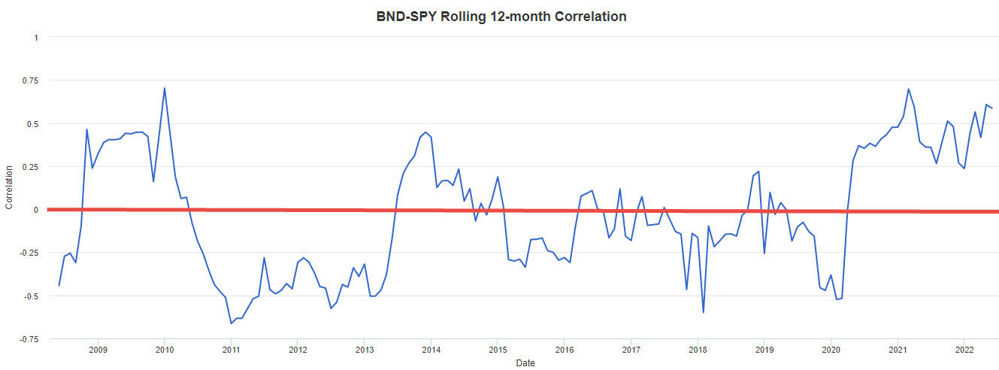

Durations above the red line mean stocks and bonds (specifically, the S&P500 and BND) are moving in the same direction.

Durations below the red line? Prices are moving in opposite directions.

At a glance, I think you'd agree there's a lot more time spent below the red line than above it. However, ever since the so-quick-it-almost-didn't-happen pandemic recession in 2020, stocks and bonds have become inseparable. They go everywhere together!

It's probably not much comfort to hear WSJ's take:

It’s the Worst Bond Market Since 1842. That’s the Good News.

Well, those who've seen their brokerage account balances plummet so far this year will surely feel comforted knowing their great-great-great grandparents no doubt felt just as bad...

Okay, back to Verdad's analysis: The Fed's proposed actions hiking, 25-basis points in March and 50 in May won't be enough. The Fed will have to hike more. (Note – they were right!)

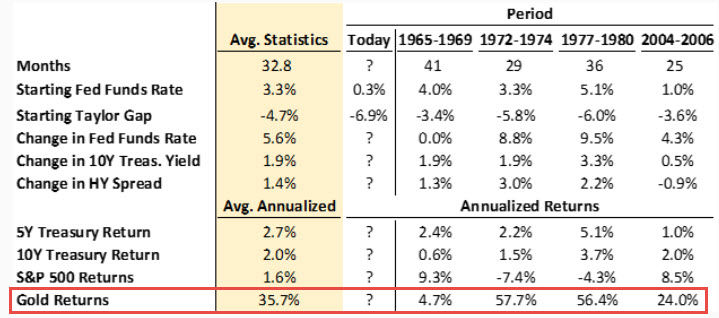

Verdad's reserachers found four other historical periods with the same set-up: high inflation, HUGE difference between the Effective Federal Funds Rate and where that rate should be according to the Taylor Rule, and – well, I'll let the chart talk for me:

Durations above the red line mean stocks and bonds (specifically, the S&P500 and BND) are moving in the same direction.

Durations below the red line? Prices are moving in opposite directions.

At a glance, I think you'd agree there's a lot more time spent below the red line than above it. However, ever since the so-quick-it-almost-didn't-happen pandemic recession in 2020, stocks and bonds have become inseparable. They go everywhere together!

It's probably not much comfort to hear WSJ's take:

It’s the Worst Bond Market Since 1842. That’s the Good News.

Well, those who've seen their brokerage account balances plummet so far this year will surely feel comforted knowing their great-great-great grandparents no doubt felt just as bad...

Okay, back to Verdad's analysis: The Fed's proposed actions hiking, 25-basis points in March and 50 in May won't be enough. The Fed will have to hike more. (Note – they were right!)

Verdad's reserachers found four other historical periods with the same set-up: high inflation, HUGE difference between the Effective Federal Funds Rate and where that rate should be according to the Taylor Rule, and – well, I'll let the chart talk for me:

Historically speaking, based on Verdad's research, gold price surges nearly 36% on average during times like these.

That's why we're calling the recent 6-month low in gold's price a sale brought to you by the Federal Reserve. If you buy gold today, and if history repeats itself, you'll be very happy you took advantage of these “discount prices“ while they last.

Paul Vanguard is a lifelong precious metals enthusiast and a proud member of the BullionMax team.

Historically speaking, based on Verdad's research, gold price surges nearly 36% on average during times like these.

That's why we're calling the recent 6-month low in gold's price a sale brought to you by the Federal Reserve. If you buy gold today, and if history repeats itself, you'll be very happy you took advantage of these “discount prices“ while they last.

Paul Vanguard is a lifelong precious metals enthusiast and a proud member of the BullionMax team.