Posted on September 02, 2021

By Paul Vanguard, for BullionMax.com

As the last two years have highlighted (as if we needed a reminder after the last fifty years), physical precious metals always seem to enjoy a seller's market. They're always easy to liquidate, whether during prosperous times when anyone can afford to buy them, or during a risis when everyone wants them. times of crisis or prosperity.

During good times, high premiums over spot price on quality gold and silver bullion are the norm. During a crisis or a panic, gold and silver sell out fast.

Here at BullionMax, we buy gold and silver from individuals every day. We make the selling process as simple and straightforward as possible. Whenever we receive a "Do you want to buy my…" call or email, we always start with one question:

Why are you selling?

This isn't meant as an accusation, not at all. After all, hedge funds and central banks push paper gold and silver around all the time.

But they aren't people. When it comes to individuals and physical bullion, well, things are different.

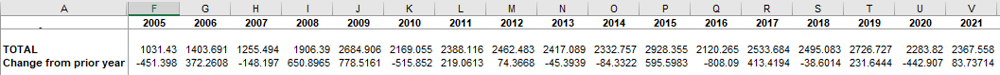

Central banks sell gold when they need liquidity (that's the finance term for what grandpa used to call "spending money"). The World Gold Council tracks central bank gold stores, and they indeed fluctuate over time:

Interestingly, today's central bank reserves are 2.3x greater than in 2005.

Sometimes, our customers need to sell gold and silver for the same reasons. We understand. Folks like you and me can't print our own money. We can't pay for medical bills or home repairs with an IOU.

In our opinion, though, this might be the only circumstance when it's prudent to sell your bullion. That should tell you a lot about our views on the physical precious metals asset class.

As an investment, we don't think precious metals should be "timed." (Though it certainly helps if you bought before the price soared.) Most individuals, most people like you and me, buy precious metals topreserve savings with an asset that has no counterparty risk.

Only very unexperienced (or desperate) investors are going to see gold or silver jump by 10% or 20% and sell their bullion to "lock in" profits. What, exactly, are you locking your profits into? Currency, that bleeds away value to inflation every day?

If you want to "play the market," physical precious metals, gold bars and silver coins, probably aren't for you. Download Robinhood on your phone and gamble with paper gold and silver instead. Understand you do so at your own risk. If you're going to be jumping into and out of gold and silver, you'll be able to jump faster with your pockets stuffed with paper rather than Krugerrands and silver eagles.

But before getting started on your day-trading aspirations, consider William Bernstein's advice from The Investor's Manifesto:

Investors who cannot approach the market rationally and systematically are better off putting half of their money under the mattress, then lighting the rest on fire and throwing it out the window.

Now, if you were speculating on precious metals prices, there might have been a case to sell gold when it hit $1,910 in 2011. I know, that's a million years ago.

Well, you could've sold your bullion when gold hit $2,070 last August for some quick profits. Maybe you did! Maybe you even felt a little smug about it!

I hate to poop on your party, but August inflation came in at 5.4% year over year. Where exactly did your profits go? If you bought a house, or bacon, or one of the other handful of assets worth more today than a year ago, congratulations! Otherwise, apologies.

As Wolf Richter said back in June:

Inflation is a game of Whac-a-Mole. One pops up as another backs off. So it could very well be that CPI inflation may be 4% next May, down from 5% now, and we’ll be celebrating that the 5% was “temporary,” and was replaced by 4%, hahahaha. But the purchasing power of the dollar that is lost every month is lost permanently .

I mentioned " counterparty risk " earlier. That's the probability that the other party in a transaction will default, leaving you holding the bag. That's a risk inherent in every promise to pay, in every paper-based transaction where nothing of intrinsic value is exchanged.

That's why you hear people call paper money like the dollar "fiat currency." A fiat is an arbitrary order or decree: "You will treat this piece of paper as though it has value because I say so!"

That requires trust. Right? Trust is a rare commodity these days, even rarer than gold.

We're hearing things like the "end of the dollar," even though nobody expects it to happen tomorrow. But many do indeed expect it. The U.S. dollar rests on nothing but faith and trust, as do all currencies. At the end of the day, anything's worth what you can get for it.

Just to be clear, we don't expect the dollar to vanish overnight. It'll more likely suffer the slow, agonizing death-of-a-thousand-cuts from inflation, slowly declining from the world's global reserve currency to a historical footnote.

That leaves investors with a question of what money and value really is. When all else fails, precious metals still fit into those roles. They did so when things like stocks, bonds and paper money weren't yet invented. And they'll continue if everything else evaporates, or is replaced by something new (or even something old).

Unless they're in search of some much-needed liquidity, we ask potential gold sellers another question:

Why did you buy it?

Some people buy physical gold and silver to add to their coin collections. Some buy to build up a crisis emergency fund. Some for reasons of financial privacy. Most people, though, buy precious metals as a safe haven investment they can hold in their hands.

We tend to ask if anything's changed… Did you stop collecting coins? Do you think the chance of a crisis has declined? Have you found financial privacy rules to be improving? Have the risks of owning precious metals suddenly increased?

Often, simply reflecting on why you bought gold or silver in the first place changes peoples' minds.

If it doesn't, though? We'll make an offer. Because, believe me, after the last two years I will never be happy until our warehouse is so packed with gold coins and silver bars we can barely drive the forklift around.

The primary lesson I've learned after all these years in the precious metals market is, for every seller there's a buyer.

Paul Vanguard is a lifelong precious metals enthusiast and a proud member of the BullionMax team.