Is Gold Money? Dollars, Credit and Gold Explained

Posted on March 09, 2023

In the precious metals business, the question, “Is gold money?” comes up a lot.

Why? I think a lot of people who

buy gold bullion for the first time are understandably anxious about their purchase. They just exchanged a significant stack of dollars for a relatively small, dense item whose “value” (at least its spot price) fluctuates from day to day.

So today I want to tackle the question head-on: Is gold money? What is money anyway?

What we talk about when we talk about money

Generally, we use the word “money” to describe cash – dollar bills and pocket change. That’s not the technical definition, though.

Here’s the

standard economic definition of money via the International Monetary Fund:

Money can be anything that can serves as:

- A store of value, which means people can save it today to spend it in the future.

- A unit of account, in other words a common basis for prices.

- A medium of exchange, something that people use to buy and sell from one another.

Anything that meets these three criteria can be considered

proper money. Conversely, anything that doesn’t live up to these expectations is simply failing as money.

The invention of money frees an economy from inefficient barter.

Credit too is a form of money, but it’s a little different.

Credit is a promise to pay money

in the future in exchange for money

now. (Credit is sort of like renting someone else’s money for a while.)

There’s a clear difference! When you buy something and pay with money, the transaction is over.

Settled, in financial terms.

When you buy something with credit, though, you take on a debt – a promise to pay money in the future. The transaction is

not complete until you make your final payment. In the meantime, you and the lender have to trust each other. The lender trusts that you won’t change your name and move to Kazakhstan. You trust the lender won’t suddenly change their mind and demand payment in full right now.

Crucially,

proper money doesn’t require the same trust as credit.

“Gold is money. Everything else is credit.”

This quote comes up a lot – it’s from the legendary banker James Pierpont Morgan, whose 1912 Congressional testimony contained this gem.

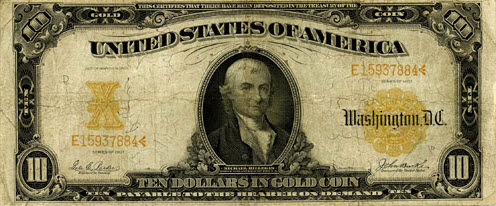

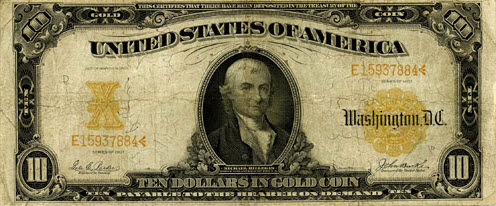

What did he mean? Well, back in 1912, paper money looked like this:

Here’s the important part: “ten dollars in gold coin payable to the bearer on demand.”

That piece of paper is a

claim on gold coins. It’s a promise from the U.S. Treasury that there really is $10 in gold coins, sitting in a vault somewhere, waiting for whoever happens to own the paper. It’s a promise, and promises require

trust.

What J.P. Morgan means is pretty straight-forward! “It’s cheap and easy to print paper promissory notes.

Show me the gold.”

It’s important to note that, back in 1912, the U.S. was on the gold standard. In other words, the price of gold was set by legislation, and the value of every dollar was measured in fractions of an ounce of gold. Back then, by definition,

gold was money.

What about today?

In modern times, is gold money?

Let’s look at our three criteria:

- A store of value: Absolutely! Probably the best store of value in human history.

- A unit of account: Do people track their wealth or price goods in grams or ounces of gold? No they don’t (except in Venezuela)

- A medium of exchange: Do we use gold to settle debts or pay for services? Mostly, no we don’t (except in South Africa, where the Krugerrand is legal tender valued at the current spot price of gold – or any business that accepts Goldbacks).

In fact, the way the U.S. Mint gives

gold American eagles an absurdly low face value actually

prevents their use as a medium of exchange.

For comparison purposes, let’s reflect on the U.S. dollar.

- A store of value: In the last 50 years, the U.S. dollar has lost nearly 86% of its purchasing power. If we go all the way back to the date of J.P. Morgan’s appearance before Congress, the dollar has lost 96.7% of its purchasing power. Major fail.

- A unit of account: Does the world price goods in dollars? Yes, but less so than a decade ago.

- A medium of exchange: Yes – and before you ask, I get paid in dollars just like regular folks.

Interestingly, neither gold nor dollars pass the “money” test.

Dollars are useful as a unit of account and a medium of exchange – for measuring and transacting. They’re

terrible at preserving purchasing power, though. (That’s what we call “inflation,” by the way.)

Gold is probably the

greatest store of value in human history. However, it doesn’t make a great unit of account and it’s an

inconvenient medium of exchange. You can’t have your bullion vault pay your electric bill via ACH to the utility company.

Maybe the best thing to do with dollars is use them for transactions? And instead of relying on dollars as a store of value, use our dollars to

buy gold bullion? That would, arguably, be the best of both worlds.

Here’s the important part: “ten dollars in gold coin payable to the bearer on demand.”

That piece of paper is a claim on gold coins. It’s a promise from the U.S. Treasury that there really is $10 in gold coins, sitting in a vault somewhere, waiting for whoever happens to own the paper. It’s a promise, and promises require trust.

What J.P. Morgan means is pretty straight-forward! “It’s cheap and easy to print paper promissory notes. Show me the gold.”

It’s important to note that, back in 1912, the U.S. was on the gold standard. In other words, the price of gold was set by legislation, and the value of every dollar was measured in fractions of an ounce of gold. Back then, by definition, gold was money.

What about today?

Here’s the important part: “ten dollars in gold coin payable to the bearer on demand.”

That piece of paper is a claim on gold coins. It’s a promise from the U.S. Treasury that there really is $10 in gold coins, sitting in a vault somewhere, waiting for whoever happens to own the paper. It’s a promise, and promises require trust.

What J.P. Morgan means is pretty straight-forward! “It’s cheap and easy to print paper promissory notes. Show me the gold.”

It’s important to note that, back in 1912, the U.S. was on the gold standard. In other words, the price of gold was set by legislation, and the value of every dollar was measured in fractions of an ounce of gold. Back then, by definition, gold was money.

What about today?