Posted on May 06, 2022

By Paul Vanguard, for BullionMax.com

For all the modernization that mints have seen, the production of gold coins remains fairly similar to the processes used a century ago. This is one of the reasons why gold coins are usually sold at higher premiums over spot compared to gold bars, but certainly not the only one.

The production of gold coins can roughly be split into three parts: coin design, ore refining and minting.

The designing process is actually the longest of the three phases. It can take years to get a new design approved. This is partly why mints tend to reuse existing designs for decades. Consider, for example the American gold eagle, whose design has changed exactly once in its 36-year history. Or the Krugerrand, which hasn’t changed at all since its first mintage in 1967.

Once a design is approved, production begins on a large-scale clay model. From that, a plaster cast is taken, then reduced in size to form a coin-sized steel “master” for the coin. The designs and clay model are larger than life-size simply because it’s easier to create highly-detailed engravings in a large scale than a small one.

If you were paying attention, you’d note that the process of turning a clay model into a plaster cast would invert the engraving. In other words, the clay model is a relief (with designs raised above the surface), while the plaster cast is incuse (designs engraved below the surface). So each step in this design process actually produces the opposite of the previous design.

The steel master is used as sparingly as possible throughout the rest of the minting process. After all, it’s the template for every future coin and even the toughest metal degrades over time. So the master is used to make a hub, from which dies are made, then inspected, and finally the minting process begins.

That depends on the country… Some mints, like Perth Mint and Royal Canadian Mint, are fortunate enough to be located in gold-mining nations. Both mints refine their own nation’s gold ore before moving forward with making gold coins.

Most other mints, including the U.S. Mint, don’t have their own dedicated refining facilities. In this case the mint either sends bullion to a refiner for preparation, or buys blank coins (also called “planchets”) directly from a refinery. One of the reasons the U.S. Mint kept running out of stock of gold coins a couple years ago, during the covid panic, was because Perth Mint wasn’t supplying enough blanks for the U.S. Mint to turn into American eagles.

Okay, so, now that we have our blanks, let’s get to minting them.

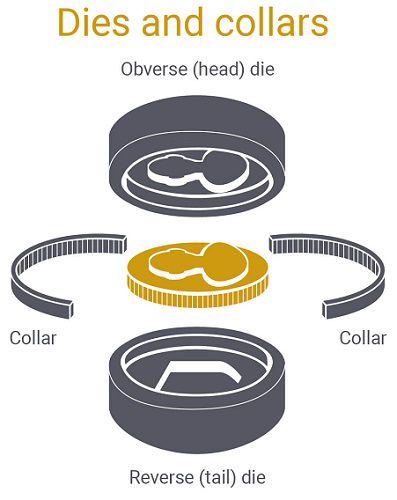

Once the blanks have been cut and prepared (usually by washing and sometimes polishing), they’re placed into the minting press. The blank goes between two dies, one for each side, and is encircled by a collar – usually reeded, but sometimes the collar itself has lettering or some other design engraved on it.

The minting press crushes it all together with up to 60 tons of pressure to them, squeezing the blank between the two dies so hard it expands and takes the pattern of the collar. (And if that sounds like a lot, the U.S. Mint wants you to know that the America the Beautiful 5 oz. silver coin series required not only a new, special press, but also 540 tons of pressure to mint – each. Wow.)

This piece of the minting process takes a whole lot longer to write about than to watch – modern mints to strike 80-450 coins every minute. (Though the number can still prove insufficient.) Once made, the coins are inspected and placed into the mint's vault. Only after all of this do they make it to a bullion dealer or retailer, and from there, into a buyer's collection.

Perhaps because the mints are so meticulous with their production and inspection, those coins that have a blemish or defect obtained during mintage send collectors into a tizzy. These are the coins that end up fetching head-spinning prices in auctions. Even though they’re made in fairly recent times, errors are just so incredibly rare that they’re all the more desirable.

Here, we are once again reminded of the disconnection between spot and physical gold, especially when talking coins. Gold coin demand has a minimal effect on gold’s spot price, certainly in the short-term. (Primarily because the paper gold market has, let’s say dubious backing by any physical metal.) Furthermore, world mints typically plan their production schedules and volumes well in advance. Therefore, they can usually operate rather smoothly even when physical gold demand is skyrocketing.

Over the past 40 years, demand for gold coins has swung wildly. There are months where the U.S. Mint might sell as "little" as just 10,000 ounces of gold coins, and there are those where sales exceed 250,000 ounces of gold. When sales decline, mints adjust their production schedules for a lower capacity – remember, they absolutely do not want to be holding their own gold coins! When demand recovers, well, if mints have been reducing production, it’s tough for them to ramp their numbers back up in a short timeframe.

In this regard, mints are similar to gold mining companies who often have to downsize or close their operations to cut costs during times of lower gold prices. But since it takes years to reopen a mine, we're constantly hearing about possible supply issues in the gold mining industry.

A sharp rise in gold coin demand empties out the mint's inventory and makes way for buyer scrambles and high premiums. Some might argue that gold coin demand isn't representative of overall gold demand, but an even stronger argument can be made that it is the most accurate representation. Gold coins are the primary means of exposure for everyday bullion investors. Bars aren't as popular, appealing or convenient.

Therefore, a price of a gold coin compared to spot gold is a good indicator of investor sentiment and true demand. A widening of the gap between the two means that investors are piling into the gold coin market. It can be the result of a new series being launched, though it’s more often associated with the kinds of economic conditions that spur gold investment in general.

Paul Vanguard is a lifelong precious metals enthusiast and a proud member of the BullionMax team.