Posted on December 30, 2021

By Paul Vanguard, for BullionMax.com

Any bullion investor worth his gold dust knows about the gold-to-silver ratio. It measures how many ounces of "the white metal" silver it takes to buy an ounce of gold. Right now, the ratio sits at levels that are historically warped by any standard. That's one reason why everyone's been piling into silver. It's almost unequivocally referred to as undervalued by analysts, and expectations for a big price jump are high.

But what if we were to tell you that silver isn't the only precious metal that has been going for bargain prices for uncertain reasons?

Okay, yes we're making fun of those pork commercials we all remember from the late 80s. Commodities analysts have a habit of calling gold "the yellow metal" and copper "the red metal." Since those are really the only two metals that are readily distinguishable (well, unless you count room-temperature-melters like mercury or gallium) we've occasionally seen analysts call silver "the white metal."

So: here we begin discussing platinum, which we hereby anoint "the other white metal." Possibly also known as the precious metal so quiet, many investors have fallen asleep on it.

Which is understandable. Both gold and palladium's all-time highs are still in the recent past. Silver got its day in the sun earlier this year when a bunch of kids on Reddit bought out the U.S. Mint.

In comparison, platinum? Honestly, most of the platinum-related news has been about the rise in catalytic converter thefts nationwide. Compared to its fellow precious metals, platinum has been a bore.

Platinum's current price of around $980 will have novice investors believe that it's a cheaper alternative to gold, like expensive silver. (The "other" white metal - see?)

In reality, platinum historically costs about 1.25x gold's price. This makes sense because platinum is some 15-30 times rarer than gold. Gold has been discovered on six of our seven continents (nobody looked very hard in Antarctica yet) and, by comparison, there are only four countries that have significant platinum mines.

The total world supplies of gold and platinum are barely comparable. As The Royal Mint informs us:

all of the platinum which has ever been mined would only cover your ankles in one Olympic-sized swimming pool. In comparison, many suggest that all the gold ever mined would fill three Olympic-sized pools.

So it makes sense that just 15 years ago, an ounce of platinum cost twice as much as gold.

So what's going on?

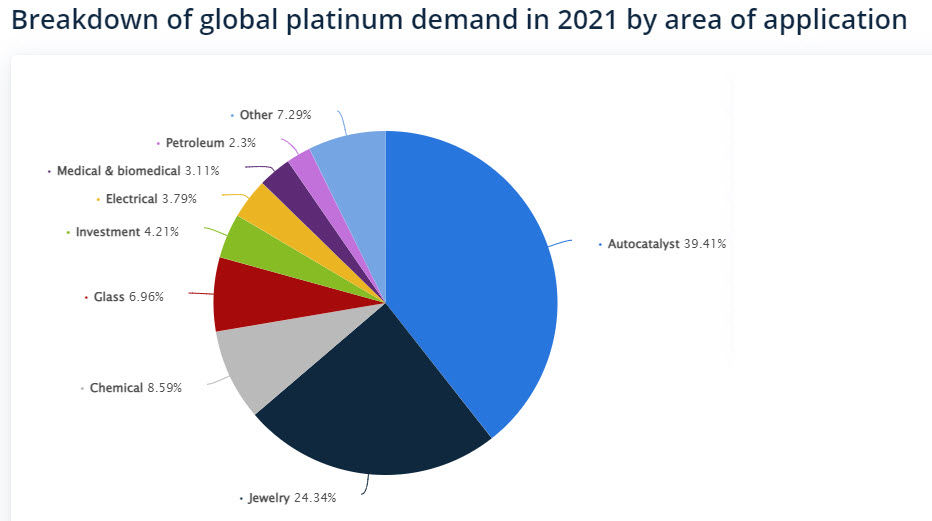

Why is it so low, then? There isn't a clear answer, which should already get you curious. Platinum has some diverse industrial demand according to Johnson Matthey:

The automotive industry is the largest single customer. That means the semiconductor shortage we've been hearing about for the last couple years that crimped automakers also reduced platinum demand from the industry.

But newfangled electric vehicles won't need catalytic converters, you're thinking… Well, platinum is critical to nearly every green technology imaginable, from electric cars to renewable energy sources. And we know how enthusiastic governments are about green technology these days.

Jewelry demand has decreased over time. Platinum's just not as fashionable as it used to be. Though there's still significant usage in jewelry.

So we're left with a puzzle… Without clear downward pressure (beyond a semiconductor shortage and jewelry fashion trends) and a whole lot of potential upside, what's a canny investor to do?

Well, bullion investors have been buying more platinum lately than you'd think. One exchange One exchange reports investor holdings of platinum have jumped 126% since the start of last year. Gold and silver, with all the attention they've gotten, have had their holdings rise by only 21% and 49% within that timeframe. That's right: platinum investment demand has grown 6x compared to gold, 2.5x compared to silver.

Wow.

It seems that however many people are waiting for silver to explode and catch up to gold, there are just as many if not more waiting for platinum's price to revert to its historical trend compared to gold. And they're buying like they mean it.

One of the best things about the precious metals market, from a buyer's view, is that entry points are prolonged. This ain't Dogecoin. There's no need to time the breakout to the microsecond.

On the flip side, when the price does go up significantly, it tends to stay there and establish a new support level. This is a big reason that precious metals are widely considered safe-haven investments.

And that's why platinum, which is sitting at less than half its normal price relative to gold, is finding its way into the portfolios of experienced investors.

If you want to join the platinum bandwagon, check out the Bullionmax platinum product collection.

Paul Vanguard is a lifelong precious metals enthusiast and a proud member of the BullionMax team.