Posted on October 12, 2021

By Paul Vanguard, for BullionMax.com

As seen on Wolf Street, on October 1, the Federal Reserve released data that reaffirmed something we already knew: the rich get richer, and the rest of us struggle, running just as fast as we can so we don't fall behind.

This isn't news. There's a reason it's called "the rat race," after all. Even small business owner/operators like yours truly are subject to macroeconomic forces.

Here's what is new: the same force that's lifting the net worth of the super-rich higher and higher is the same force shoving the rest of us down. And that force isn't a natural economic power at all. It isn't Adam Smith's invisible hand. It isn't the ironclad law of supply and demand.

Nope. It's the Federal Reserve.

The Fed operates with something called the "wealth effect", a term that officials have used numerous times but one that has fallen out of favor for -- well, you'll see. The term itself isn't particularly sinister, is it? After all, this is America! Everyone has a fair shot at getting rich!

That's not what the "wealth effect" is about. It's part of the official foundation for the Fed's monetary policy, and it's been described dozens of times. Most tellingly, former San Francisco Federal Reserve Bank president Janet Yellen, way back in 2005 , wrote:

As part of its analysis of demand in the economy, central bank models have long incorporated the wealth effect of house prices and other assets on spending.

That's not particularly enlightening… Never fear! In 2010, Fed chair Ben Bernanke explained the "wealth effect" to Americans. Not on cable news. Not in a press release, or at a press conference. Nope, he chose the editorial page of the Washington Post (probably hoping the readership would self-select). He wrote:

Easier financial conditions will promote economic growth. For example, lower mortgage rates will make housing more affordable and allow more homeowners to refinance. Lower corporate bond rates will encourage investment. And higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending. Increased spending will lead to higher incomes and profits that, in a virtuous circle, will further support economic expansion.

There it is, in a nutshell. The "wealth effect" is the Fed's never-ending quest to boost asset prices. That's it! If your stocks go up, it will "help increase confidence" which is good to "spur spending."

How do they do this? Same as always: by suppressing interest rates and quantitative easing. Cheap money encourages people to spend it. There's a side effect called inflation, but that's okay in the Fed's view. If you're afraid of inflation, well that'll "spur spending" which will "further support economic expansion."

Now, this might be mistaken for a useful economic model at first glance. After all, a rising tide lifts all boats, right?

Unfortunately, that's now how the "wealth effect" works.

In the real world, the "wealth effect" plays out like this:

The wealthier you already are, the more you benefit

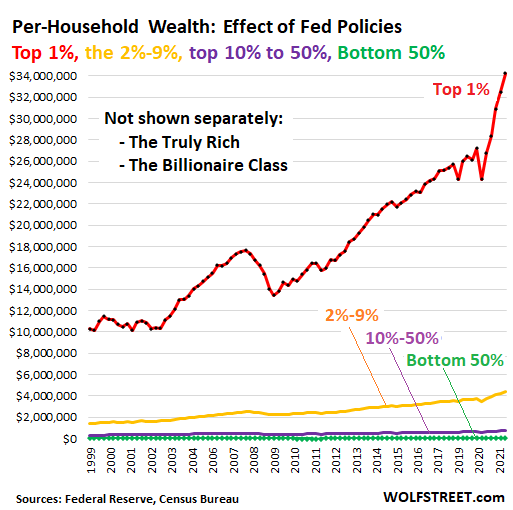

Wolf Richter put together this handy chart:

Since Alan Greenspan's first forays into stock market support in the aftermath of the dot-com bubble, the Federal Reserve has intervened in financial markets with increasing frequency and vigor.

By "intervened," I specifically mean, kept interest rates low and money flowing.

As you can see from the chart, the folks who most appreciated these loose-money policies already had plenty of money. The Fed just helped them get more.

Let's break it down just a bit more…

You've heard of the 1%, so that might be a good place to start, or a bad one. By definition, the 1% amounts to just over a million households in a nation with over 126 million households. Since the monetary stimulus started last year, the average 1% household gained $9.95 million. (That's some heavy averaging, too, as the widening of the gap is also present in the 1%. The more billions, or trillions, you have, the more you've gained.)

Why? Simply because the 1% hold most of the assets. As asset prices rise, so does their wealth.

Things get pretty wonky when we take into account the 99%.

For starters, 62.2 million households are considered the "bottom 50%" in terms of wealth, with an average of $47,900. That average is only as high as it is because, in the same timeframe, the bottom 50% gained $18,600. Over half of the wealth of the people in this class is durable goods, and they have little to no assets.

Close to half of Americans fall in the bottom 50%, but let's not get deceived into thinking that the 49% is seeing some equal distribution.

Take another look at the chart above. Clearly, the "wealth effect" doesn't boost all Americans equally.

Nor does it penalize us all equally…

As Richter points out in another article :

There are the negative consequences of the Fed’s asset bubble policies for the bottom 50%: Life gets more expensive. Housing costs surge, and other prices surge too, and buying those durable goods gets more expensive, and thereby the Fed, with its inflation goals, is cutting the purchasing power of labor of the bottom 50%.

See, the less money you have, the more of your total income gets spent on necessities: food, housing, utilities and transportation. These are not inelastic. In other words, if the price of gas goes up you can't just decide not to drive to work today. If food costs too much, you don't opt for a multi-day fast.

Inflation hurts less-wealthy American families the worst .

Richter describes the typical net worth of a bottom 50% household:

For the Bottom 50%, real estate is their largest asset at $68,504 per household. This means that relatively few households own real estate. And they have on average $40,122 in mortgage debt, which leaves them with $23,382 in home equity.

They own practically no stocks and mutual funds ($4,122 on average). And inflating the stock market, as the Fed tries to do, just leaves them purposefully further behind.

But they own $25,970 in “durable goods,” which the Fed counts as assets, rather than consumables. If you don’t count these consumer goods as assets, the wealth of the bottom 50% shrinks to $21,948.

So when asset prices rise, they leave the bottom 50% behind.

In short, someone who is considered an American in good financial standing, the people we think of as "salt of the earth," well, the Fed's policies actively make their lives worse. Not only do they have to cope with low pay, they're now facing soaring prices on the necessities like food, housing and energy.

This is the group most punished by inflation.

Now, you may ask whether this is deliberate. I doubt it! I don't think, in their wildest dreams, Janet Yellen and Jerome Powell fantasize about increasing the economic trials of the least-wealthy Americans.

What I'm afraid of is they're well aware of the havoc they're wreaking, and accept it as "collateral damage." Yes, Fed policies make life harder for the disadvantaged, but if that's acceptable to the policy-makers at the Federal Reserve, they're actively engaging in unprecedented class warfare.

The only way to resist? Same as any carnival game: don't play. Opt out of the Federal Reserve's rigged economy and put yourself on your own gold standard. Swap your currency for an asset that can't be hacked, tracked or inflated away.

Independence means the ability to examine alternatives and make your own, informed decisions about your life. Make your own rules.

Paul Vanguard is a lifelong precious metals enthusiast and a proud member of the BullionMax team.