Posted on March 23, 2022

Anyone who owns or invests in physical gold bullion and stores it at a depository has to make an important choice between allocated and unallocated gold bullion. Our goal here is to describe the difference between these two forms of ownership to help you decide which is right for you.

There is no right answer when it comes to selecting between allocated and unallocated gold bullion. But every individual has to choose which of these investment options is best suited to meet their unique needs.

Owning gold today is easier than ever before, thanks largely to the seamless experience of buying precious metals online. While buying bullion online is almost always the most convenient way of accessing various gold products, some people prefer to buy gold at local coin or pawn shops, from precious metals dealers, or local coin auctions.

Owning gold today is easier than ever before, thanks largely to the seamless experience of buying precious metals online. While buying bullion online is almost always the most convenient way of accessing various gold products, some people prefer to buy gold at local coin or pawn shops, from precious metals dealers, or local coin auctions.

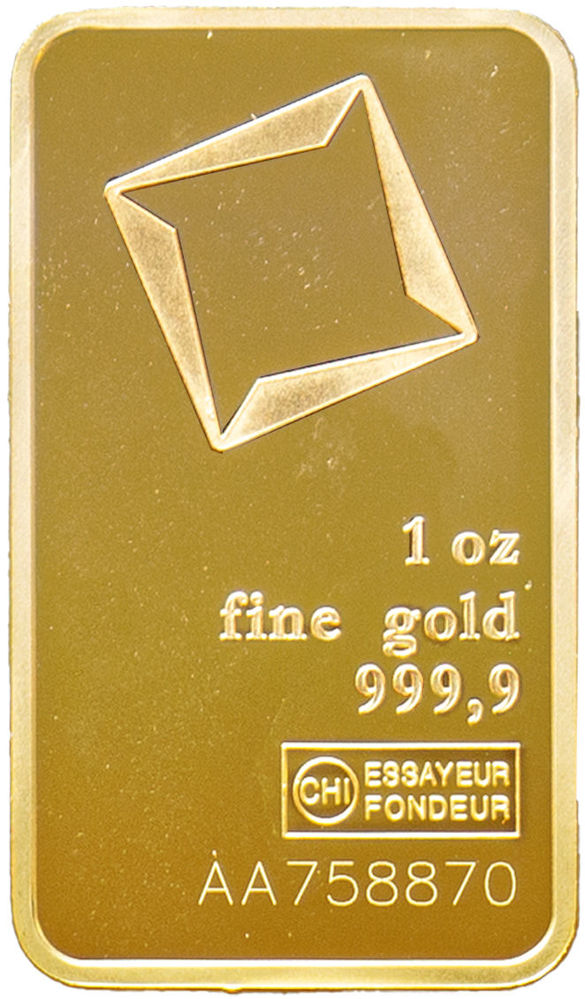

Gold bullion comes in the form of bars, coins, and rounds. (If you’re wondering whether your gold necklace is considered bullion, the answer is no – it’s jewelry. Its primary benefit is decorative, and though it definitely has intrinsic value, gold jewelry isn’t valued primarily based on its weight of gold) Bullion is most often depicted as an ingot, which is the oblong shape gold bars are frequently cast into. Gold bullion ingots are sometimes an intermediate form of gold – refined metal ready to be transformed into coins, jewelry, electrical components, or many other end uses. However, there’s more to gold bullion than bars.

Physical gold bullion can also consist of coins like the American eagle gold bullion coin or rounds. “Rounds” are what we call disc-shaped pieces of gold that resemble coins but have no face value or government guarantee (since private mints rather than official government mints make them).

While you can own gold in many different forms, it’s important to distinguish between owning paper gold and owning physical gold bullion. Paper gold can mean gold ETFs, stocks, futures and other financial derivatives, and even shares in a company that mines gold. Physical gold bullion, on the other hand, is limited to:

Virtually all physical gold bullion is made with high-purity (0.995+ pure) gold. Furthermore, there are two very different ways to own physical gold bullion…

Allocated gold bullion is gold that remains the property of the individual gold investor. With allocated gold bullion, regardless of where it is stored, you can take possession of your specific gold items at any time. Many gold bullion investors choose to keep their gold in storage at a precious metals depository or bullion vault.

Allocated gold is segregated gold – actual physical metal – that is set aside and owned directly by the investor. You can think of allocated gold storage as if it’s a safe-deposit box. The items you put into the box are exactly the same as those you remove from the box.

For example, let’s save you have two 1 oz gold bars from the Perth Mint with a serial number of XXXXX1 and XXXXX2, and you put them into allocated storage at a depository. Even though the depository has hundreds of 1 oz Perth Mint gold bars, they will not intermingle yours with the others. That means when you take your gold out of the depository, you’ll get the same two bars back – serial numbers XXXXX1 and XXXXX2.

Investors who choose allocated storage for their gold bullion prefer to have free access to and direct possession of the specific gold bars, coins, and rounds they own.

Choosing allocated gold bullion comes with the benefit of being the sole and complete owner of the precise gold bars, coins, and rounds you own. Maybe you inherited gold from a parent, grandparent, or other loved one that holds sentimental value? Or you just want to keep your specific coins, bars, or rounds and will accept no substitutes? In both cases, allocated storage keeps your gold from getting mixed up with other people's gold.

You may choose to utilize the services of a financial institution to keep that gold safe, but the institution is merely a steward for your gold, which must be returned to you at your request or in the event of liquidation.

Another benefit of allocated gold is the fact that you have a standalone investment, which performs independently of banks. If the banks fail, you still own a tangible investment (not only a great comfort but quite possibly suddenly worth a whole lot more overnight!).

Along with its benefits allocated gold bullion also comes with an increased level of responsibility. It is important for those who go the way of allocated gold bullion to account for the costs associated with this type of gold ownership. Allocated gold bullion often includes ongoing costs of storage and insurance, which continue for as long as you own the gold.

Since allocated gold bullion requires its own dedicated space and cannot be used or stored with other gold by the financial institution holding it, individual owners have to bear higher storage costs than unallocated storage. In addition, banks will also charge more for allocated gold bullion because they don’t have the flexibility to loan the gold out to speculators, basically leveraging your property to make a profit for themselves.

Finally, there is the obvious, inherent risk of loss or damage an owner carries with allocated gold bullion. Though it may be unlikely, the threat of loss, damage, or theft can be a complete disaster, and there is no recourse outside of insurance – if the loss is even covered. Fortunately, allocated bullion vaults and depositories tend to be some of the most secure places on the planet. Still, it makes sense to read the fine print on any contracts you sign…

There are many examples of allocated gold bullion. The first that probably comes to mind for most people is buying gold bullion and storing it in a safe deposit box at a local bank or credit union. Allocated gold bullion can also include specially marked allocated accounts at some dealers, depositories, and the increasingly popular option of a gold IRA.

Unallocated gold bullion is gold that is not the physical property of the investor, but a deposit of gold to a bank, precious metals depository, or other financial institution. A customer who chooses unallocated gold bullion becomes an unsecured creditor to the bank or precious metals dealer.

With unallocated gold bullion, the gold remains the property of the bullion bank and is never in possession of the investor; in exchange, the investor receives a paper receipt for the gold deposited, along with the backing of the bank’s gold reserves.

With unallocated gold bullion, the gold remains the property of the bullion bank and is never in possession of the investor; in exchange, the investor receives a paper receipt for the gold deposited, along with the backing of the bank’s gold reserves.

Unallocated gold bullion offers a very similar setup to traditional fractional reserve banking, whereby the money you deposit isn’t kept by the bank but used for other purposes like funding loans. Essentially, you’re depositing your weight of gold in exchange for an IOU from the bank. And just like cash deposits, banks may not even choose to store your gold deposit.

Unallocated gold bullion offers a more affordable option for investing in gold than allocated gold. The unsegregated gold-stock makes for easier and more efficient bank operations and allows the bank to use the gold for withdrawals and loans. Unallocated gold becomes “fungible,” a finance term that means “indistinguishable from the same amount of the same commodity.”

For example, when you deposit a $20 bill at the bank and later withdraw $20, you don’t get the same bill with the same serial number. Banks commingle your cash deposits with everyone else’s. Instead of a specific stack of bills, you “own” the right to withdraw a quantity of money from the bank.

Unallocated bullion generally has lower insurance costs, too, since banks hold a larger volume of gold and don’t need to track individual items and can pass along these savings to investors.

Unallocated gold bullion has some risks and drawbacks that investors should be aware of. Unallocated gold investors rely on the bank that issues their IOU, exposing them to significant risk in the unlikely event of bank failure. As an unsecured creditor, investors can theoretically lose their gold investment if the bank goes belly up. There’s no FDIC insurance for gold deposits.

Another potential drawback is that investors making withdrawals will likely be given gold that is different from what they deposited. Though unlikely, it is possible this could leave them open to fraud or inferior, less-popular products.

Lastly, unallocated gold exposes investors to market risks that accompany investing in any publicly-traded security such as ETFs and other investment funds. Though the investment is in gold, other factors like counterparty risk, operational risk, and liquidity risk come into play with unallocated gold that can negatively impact the price of a gold ETF or similar security.

Unallocated gold bullion can be as simple as unallocated accounts at banks or depositing gold bullion into unsegregated storage. There are also dozens of popular ETFs (GLD, IAU, OUNZ) and investment funds that are prime examples of unallocated gold bullion.

| Allocated Gold Bullion | Unallocated Gold Bullion |

|---|---|

| Remains the property of the investor | More affordable investment option |

| Independent performance | Less expensive to insure |

| More flexibility | No direct ownership of gold |

| More expensive to store and insure | Investment risk due to external factors not necessarily affecting the price of gold (e.g., the performance of banks, parent company acquisition) |

| Risk of loss, damage, or theft (if stored at home. Minimal risk if stored at a depository) | Security of banks makes loss, damage, or theft unlikely |

| Ready access to the full quantity of gold | Investors cannot expect to receive the gold they deposited |