Posted on June 22, 2022

If you’re considering adding platinum bars to your precious metals collection, we’re here to help you choose which platinum bars are best to buy. Let’s walk through what factors you should take into account, some popular options to consider, and how you can actually purchase platinum bars.

Platinum bullion bars offer a few advantages over their precious metals counterparts. Compared with platinum coins, platinum bars carry a lower premium over spot pricing, taking your investment further.

Platinum bullion bars offer a few advantages over their precious metals counterparts. Compared with platinum coins, platinum bars carry a lower premium over spot pricing, taking your investment further.

Platinum also stacks up well against gold and silver for a couple of reasons. Compared with gold and silver, platinum is a significantly rarer metal – on average, 17 times more gold than platinum is mined yearly. In addition, it’s also more durable, making it ideal for jewelry. Before World War II, platinum was considered the best precious metal for jewelry-making. All of the finest engagement rings and wedding bands were exclusively platinum. Due to its density and durability, platinum preserves highly detailed engravings and designs far longer than either gold or silver.

Platinum is uniquely useful for a variety of manufacturing purposes, including automotive catalytic converters, media storage, biomedical devices, and electric vehicles.

Finally, platinum is often priced more modestly than gold per ounce, which gives platinum buyers an opportunity to add more ounces to their collection with the hope of future price appreciation.

Choosing platinum bars comes down to evaluating a few critical factors. We’ll walk you through the primary considerations step by step.

The mint or refiner is the equivalent of a brand when it comes to platinum bars. The top names in the industry have rigorous standards of quality and are easily recognized, which can facilitate quick sales. If you can, try and buy products from the most reputable refiners and assayers, like Valcambi, PAMP Suisse, Argor Heraeus, Johnson Matthey, or Engelhard. Note also that the London Platinum & Palladium Market maintains a Good Delivery list – it’s never a bad idea to consult that list to ensure a particular refiner remains in good standing with such an important industry association.

Platinum bars come in various weights. As with all precious metals, generally speaking, platinum bars that are larger offer lower premiums over spot price.

However, you can’t easily split a 10 oz platinum bar into 10 even 1 oz pieces. Smaller platinum bars may come at a higher cost per ounce but may be easier to barter with or sell. Generally, you can purchase platinum bars ranging from as small as 1 gram up to 10 oz (or more). As with other precious metals, the “standard” weight for platinum bars is 1 oz. (The LOCO London market uses platinum bars of 1-6 kilos or 32-193 troy oz for physical settlement, though bars of this size are very rarely commercially available.)

Fineness refers to the purity of the precious metal. Platinum bars are usually 0.9995 fine or 99.95% pure, as required by Good Delivery guidelines.

With a self-directed IRA, you can hold precious metals in your retirement portfolio. Regardless of size, only platinum bars with a minimum purity of 99.95% are IRA eligible if they are manufactured by an NYMEX or COMEX-approved assayer/refiner or a sovereign mint, according to IRS guidelines. To find out more about precious metal IRAs, click here.

The most popular platinum bars can sell out quickly, so it’s important to check the availability of the platinum bars you’re interested in purchasing. 1 oz platinum bars are generally the most available and easiest to find on the market.

There are hundreds – if not thousands – of platinum bars to choose from. Here are some of the most popular options:

Valcambi is consistently one of the most highly-regarded refiners in the world. Valcambi’s 1 oz platinum bar is always an excellent choice, as is the versatile CombiBar, which is a 25 g platinum bar that’s easily divisible into 1 g pieces – like a platinum Kit Kat bar. Valcambi effectively solved the problem of “making change” in a barter transaction!

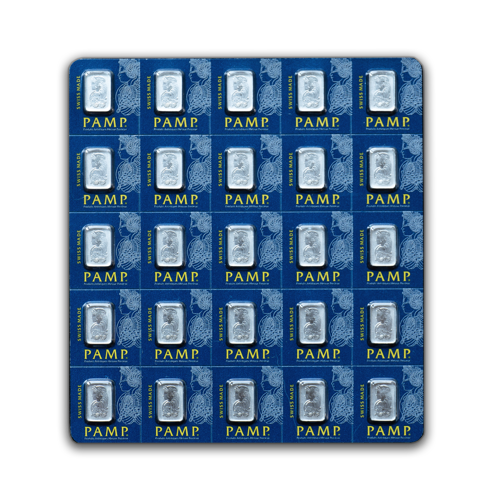

PAMP Suisse

PAMP SuissePAMP Suisse, like Valcambi, is another top Swiss refiner. PAMP Suisse platinum bars come in various sizes, from as little as 1 g and 5 g to 1 oz or 10 oz. Additionally, PAMP Suisse has a divisible platinum product comparable to Valcambi’s CombiBar, which allows for quickly and easily breaking off smaller pieces from a larger bar.

Engelhard was an American refiner and mint that is now defunct. During its 100+ years in operation, Engelhard made high-quality bullion products, like its 1 oz and 10 oz platinum bars. Since the mint was shut down and their products are no longer being made, Engelhard platinum bars can often fetch a premium over other comparable bars.

Argor Heraeus, another reputable Swiss refiner, makes platinum bars in four sizes, delivering a dependable, well-known bullion product. Argor Heraeus platinum bars vary in weight from 1 oz, 100 g, 500 g, and 1 kg.

Johnson Matthey is a British refiner that’s over 200 years old and is known as one of the leaders in refining platinum and other metals. In fact, they’re the largest secondary platinum refiner in the world (focusing on recovery/recycling).

Johnson Matthey platinum bars are commonly found in 1 oz denominations but are also available in smaller sizes like 5 g and 20 g.

Most refiners and mints don’t sell directly to the public. Instead, they rely on a network of distributors and dealers to handle fulfillment and customer service for retail orders. You can buy platinum bars online from trusted bullion dealers like BullionMax. Alternatively, you can browse for platinum bars in person at coin shops or events like coin shows or auctions.

If you’re okay with taking some risks, you can also buy platinum bars at online auction sites like eBay. Be warned, however – it’s virtually impossible to buy platinum bars (or any other precious metal) for less than their melt value (spot price per ounce). Virtually everything that purports to offer below-spot prices is a scam. We recommend buying from a dealer who gets authentic platinum bars straight from the refiners.

Before you buy platinum bars, consider some other factors in addition to those mentioned above. These include:

You’ll need to have a secure storage space designated for your platinum bars to protect them from theft and damage. You can learn more about your bullion storage options by clicking here.

Always keep your platinum bars insured from the time of purchase until the time you sell them. Though secure storage is important, insurance may help make you whole in the event of a fire, theft, or loss. Many precious metals investors that store in a home safe add an umbrella policy to their home insurance to cover their purchase.

Do you want to invest your platinum bars in a precious metals IRA? Do you prefer to keep your bullion in a precious metals depository? Only you can decide where you want to store your investment in platinum bars.

Start your journey by visiting BullionMax and checking out our selection of top-quality platinum bars.