Posted on June 09, 2022

Silver bars – which can be produced by a refiner, government mint, or a private mint – are an excellent way to invest in precious metals, especially for investors looking for some of the benefits of buying gold without the hefty price tag. Besides being widely used in the jewelry industry, silver is an extremely useful industrial metal, and has been used as money for long periods of history. While not as popular as gold, it can still serve as a hedge against inflation and economic challenges.

Investors might choose silver bars over silver coins or rounds because they offer a lower premium over spot pricing and are easy to store, thanks to their stackability and availability in greater weights. Silver is unique among its precious metals counterparts because of its very accessible price point, with an ounce of silver trading at a small fraction of the cost of gold, platinum, or palladium.

Investors might choose silver bars over silver coins or rounds because they offer a lower premium over spot pricing and are easy to store, thanks to their stackability and availability in greater weights. Silver is unique among its precious metals counterparts because of its very accessible price point, with an ounce of silver trading at a small fraction of the cost of gold, platinum, or palladium.

Finally, silver has various industrial applications in electronics and medicine, which gives it the potential to appreciate due to increased demand from manufacturers.

Here are some factors to consider when choosing which silver bars to buy.

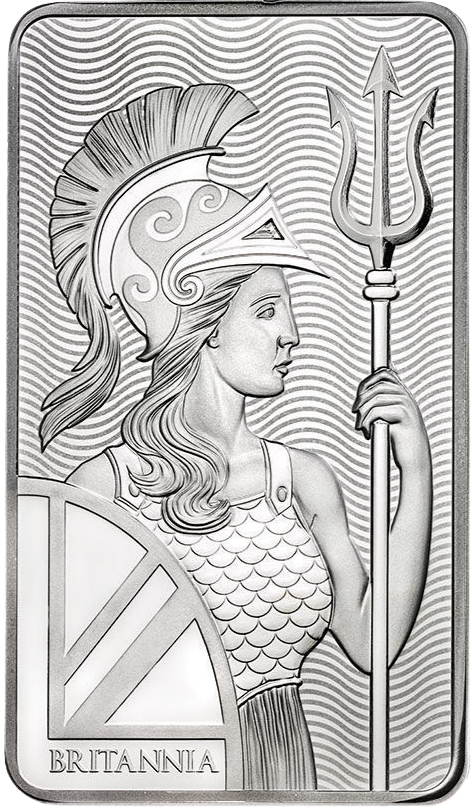

The brand or assayer of silver bars can help guide you in the right direction when buying silver bars. Some of the top brands include Valcambi, the UK’s Royal Mint, Asahi Refining, Credit Suisse, Sunshine Minting, and SilverTowne.

A London-based bullion market association (who doesn't like their name to appear in print) is the leading authority on bullion products. They maintain a Good Delivery List is a list of accredited refiners who meet their rigorous standards. These companies offer the highest quality products, so you can rest easy when buying silver bars made by any Good Delivery-accredited refiner.

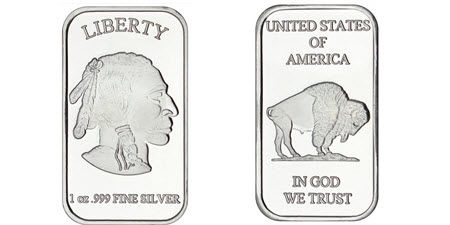

The size and weight of silver bars can play a big part in deciding which silver bars to buy. Silver bars come in various shapes and sizes, like 1 oz, 5 oz, 10 oz, and even 100 oz – the largest generally available are 1,000 oz silver bars usually called “COMEX deliverable.” Sometimes, silver bars are poured and stamped or simply cast as ingots (common with 100 oz bars); other times, silver bars are neatly minted in near-perfect rectangular bars, often bearing intricate designs.

While larger bars cost more overall, as a general rule, larger bars offer lower premiums over spot per ounce. If you think you might want to split your silver bars into fractional pieces, the 100 g Valcambi CombiBar provides a single bar you can easily break into even pieces.

Most investors prefer the finest possible silver bars. Some mints, like the Royal Canadian Mint, produce silver bullion at 0.9999 fineness, though there are many respectable mints that produce silver bars of 0.999 purity. Silver bars must be at least 0.999 fineness to qualify for trades on exchanges.

If you intend on investing silver bars in your IRA, make sure the bars you buy meet the rules and regulations set forth by the Internal Revenue Service’s (IRS) section 408(m)– mainly, regardless of shape or size, the silver needs to be at least 0.999 fineness.

Be sure to check which silver bars are actually available at the time of purchase. You may want a particular product, but popular silver bars often sell out quickly.

Assay packaging makes it easy to verify the authenticity of a silver bar and protect it from damage. In addition, assay packaging can help ensure you get the full value of your silver bars when it comes time to sell. A silver bar without an assay certificate might require chemical testing for purity before a buyer would accept that it’s the real thing – assay packaging is designed to build trust in the authenticity of the enclosed silver bar.

How do you buy silver bars?

How do you buy silver bars?You can buy silver bars online from a trusted online bullion dealer like BullionMax. Online dealers generally have the best selections, lowest premiums, and inventory compared to brick-and-mortar stores. Alternatively, you can always buy in person from coin shops, pawnshops, coin auctions, or coin shows – just be wary of the pricing, quality, and reputation of the business you’re transacting with.

We recommend avoiding auction websites like eBay and Amazon for purchasing silver bars. Although these marketplaces do have many reputable sellers, you risk purchasing from a fly-by-night 3rd party seller. In this case, you may end up with damaged goods, a different product than what you paid for, or no silver at all.

Before buying silver bars, you should have a well-thought-out plan on how to store them and keep them safe. If you intend on investing silver bars in an IRA, you’ll have to store your bars with an approved depository or non-bank trustee and set up a Self-Directed IRA with a custodian.

You’ll also benefit from double-checking to ensure your silver bars are properly packaged and come complete with assay cards. Finally, you’ll want to maintain an insurance policy on your silver bars for as long as you own them, especially if you plan to store your silver in your home.

When you’re ready to buy silver bars, head to BullionMax to find the best selection at below reasonable prices, plus free shipping on orders over $199.