Posted on March 23, 2022

If someone presented you with two piles of silver bars collectively weighing the same amount, which would you choose? Here’s the thing: silver bar size matters, and it is important to understand why before choosing which bars to buy. The size of a specific silver bar has important implications, affecting price, liquidity, and ease of storage.

For investors in silver bullion, bars and coins are two of the most common product types. Two main characteristics distinguish silver bars from silver coins. First, silver bars are generally rectangular in shape, while silver coins (like almost all coins) are disc-shaped. Second, bars can be made by any mint and are only valued for their metal content, whereas silver coins have a face value and metal content value and are made exclusively at government mints.

Furthermore, minting silver coins is a more labor-intensive process that nearly always results in a higher premium over silver’s spot price compared to silver bars.

Many investors choose silver bars over silver coins, primarily because bars are more cost-efficient. In other words, bars are sold at a lower premium over the spot price of silver, so stackers can get more ounces for the same dollars. In addition, though some silver coins will stack neatly, many won’t. (There are exceptions, and stackable silver rounds are made specifically to fit into tidy, stable columns.) Generally, silver bars are easier to arrange, stack and store.

This might not be an important detail to consider when buying other precious metals such as gold and platinum since they are more valuable per ounce. However, silver’s lower density and significantly lower price-per-ounce mean that an investment in silver can quickly grow to fill a large space, making compact and efficient storage a challenge.

Silver bars come in an astonishingly wide variety of weights, meeting the needs of almost every investor’s budget. Both here at BullionMax and in the precious metals marketplace generally, 1 oz silver bars are the most popular and they’re conveniently on the smaller side of available weights. Still, there are silver bars even smaller than a single ounce, including ½ oz, ¼ oz, and the wee 5 g bar.

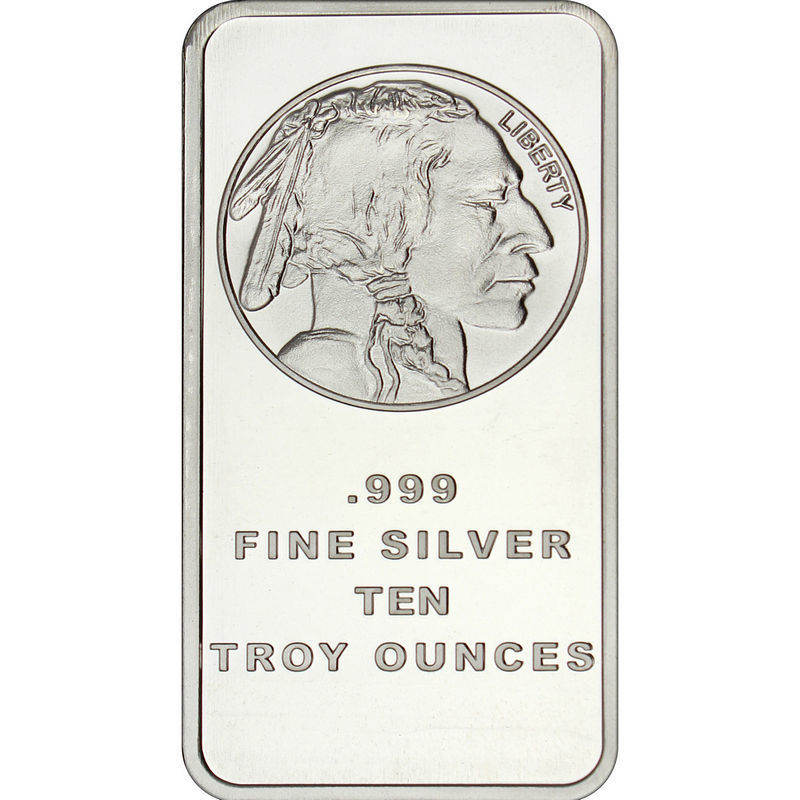

On the opposite side of the silver size spectrum, there are bulkier bars whose weights increase quickly. There are also 5 oz bars, along with the less common 2 and 3 oz sizes. At 10 troy ounces, a silver bar weighs less than a pound and will be roughly 3.5 inches long by 2 inches wide (though varies by refiner).

On the opposite side of the silver size spectrum, there are bulkier bars whose weights increase quickly. There are also 5 oz bars, along with the less common 2 and 3 oz sizes. At 10 troy ounces, a silver bar weighs less than a pound and will be roughly 3.5 inches long by 2 inches wide (though varies by refiner).

Another common bar size is 1 kilo (2.2 lbs), which is just over 32 troy ounces of silver. Going up again in size, there is the 100 oz silver bar, comparable in dimensions to the average smartphone, but weighs as much as three liters of milk. For those seeking even more silver packed into a single bar, the 1,000 oz size is as big as they usually come. At roughly one foot long by five inches wide, a 1,000 oz silver ingot is considerably larger than a brick, it is also very heavy, weighing roughly 68 pounds — about as much as an adult labrador retriever or a 10-year-old child.

Here is a list of most silver bar sizes you can buy, along with the rough estimates of their cost at silver spot prices as of March 21, 2022. We’ve bolded the weights of the most common, easiest-to-find weights.

With so many different sizes of silver bars available, choosing which bar to buy can be a real challenge. When evaluating your options, here are some factors you should consider before deciding.

The first and most important question you should ask yourself is how much silver you actually want to own. Naturally, if you only want to spend $500 on silver, you should not be looking at 100 oz bars. Generally speaking, the lighter the silver bar’s weight, the higher a premium over the spot price you’ll pay.

Not all silver bars are created equal, and, as with most products, a brand’s reputation can play an important role in the buying process. Since silver bars are often bought and sold, you want to ensure you can sell your bar quickly and easily at a fair price. To ensure the bar appeals to the most potential buyers, try and choose silver bars produced by a reputable refinery like Valcambi or PAMP.

The importance of buying a recognizable bar is even more relevant when dealing with large bars. When trading silver bullion, recognizability is one area where silver coins have the advantage over bars.

Choosing the right-sized silver bar is a critical component when buying silver bullion. If you want to buy 10 ounces of silver, a 10 oz bar may seem like the obvious choice; but if you buy a 10 oz silver bar and want to sell half of your silver at some point in the future, you won’t be able to break it in half and sell it.

Choosing the right-sized silver bar is a critical component when buying silver bullion. If you want to buy 10 ounces of silver, a 10 oz bar may seem like the obvious choice; but if you buy a 10 oz silver bar and want to sell half of your silver at some point in the future, you won’t be able to break it in half and sell it.

Thinking about your investment goals before you buy silver can help you buy the right pieces the first time. Larger pieces have the advantage of a lower premium over the spot price, making them less expensive per ounce. In comparison, smaller pieces give you the flexibility of being able to sell a portion of your silver position. Most people decide to own some larger pieces and some smaller pieces so that they can enjoy the benefits of discounted pricing and divisibility.

Among silver investors, buyers who hold silver for long periods of time are colloquially known as “silver stackers.” This nickname is both figurative and literal since these investors will actually store their silver bars in neat stacks. With silver, storage can present a challenge for investors, making stackability a vital feature for investors holding large quantities of silver bars.

A single 100 oz silver bar will take up less space than the equivalent amount of silver divided into 10 oz silver bars. One final detail to note about stackability is that silver bars from different refiners may not stack well with one another. Though the amount of silver in two bars from different refineries can be identical, the dimensions of the bars can make stacking silver bars difficult or impossible.

In addition to size, there are a couple of other important factors that come into play when comparing silver bars.

Most silver bars on the market will comprise at least 99.9% fine silver. Nevertheless, certain silver bars are made with lower-purity silver, which is something you should keep an eye out for when comparing bars.

Buying silver bars from a recognizable brand is always an intelligent choice for maximizing resale value and ensuring you are purchasing a high-quality product. Some of the most recognizable brands of silver bars are:

When silver bars are made, they are either cast or minted. The outward appearance of a cast bar is more rugged, with some imperfections and inconsistencies visible to the naked eye, like rough edges. Overall, cast bars look less expensive than their polished minted counterparts.

Cast bars are made with continuous casting machines pouring molten metal into molds, allowing it to cool and harden before stamping or engraving it. On the other hand, minted bars are cut into perfect rectangles by high-tech machines. The manufacturing process used to mint silver bars is more expensive than the relatively simple process of casting bars, making cast silver bars slightly cheaper for investors.