Posted on April 07, 2022

By Paul Vanguard, for BullionMax.com

We've covered fairly extensively how sovereign mints have had their hands full over the last few years. Mishandled product launches, delayed deliveries, questions over ore supply, sold-out inventories, websites crashed by “bots,” facilities running at half-speed thanks to Covid... And, of course, record sales.

That’s right, the U.S. Mint has had its best Q1 in 23 years.

Now, you’ve got to remember, this is on top of consecutive monthly and quarterly peaks for both gold and silver bullion sales. In March, the Mint sold 155,000 ounces of various American gold eagles. Not only was this a killer month at the end of an epic quarter, it was also their strongest March since 1999.

Now, I might be dating myself just a little bit here, but do you remember what 1999 was like? We kept seeing stories about Silicon Valley execs quitting their seven-figure jobs and buying ranches to build their own custom Y2K apocalypse bunkers. The U.S. had a Y2K evacuation plan, for pete’s sake. The phrases “bug-out bag” and “off the grid” entered the zeitgeist. In other words, 1999 was a total mess! Just to give you an idea of what these sales are up against…

U.S. Mint’s March sales were up 73% vs. February (and February had strong sales already).

So what’s hot at the U.S. Mint? It’s an easy question to answer, because they publish their production and sales figures.

In total, 452,000 ounces of gold flew off the shelves during Q1 along with 8 million ounces of silver and 40,000 ounces of platinum.

The U.S. Mint’s top bullion sellers were as follows:

#1 – 1 oz silver eagle (about 8 million total)

#2 – 1 oz gold eagle (350,000 sold)

#3 - 1/10 oz fractional gold eagle (295,000 coins sold, representing 29,500 oz of gold)

That’s right – despite the wild popularity of the affordable 1/10 gold eagle, the U.S. Mint still cranked out more 1 oz gold eagles than their baby brothers.

Remember, they don’t just make bullion coins! Our national mint’s top proofs were as follows:

#1 – Proof silver American eagle (1.8 million)

#2 – 1 oz platinum proof eagle (43,000)

#3 – 1/10 oz proof baby eagle (39,000)

Frankly, I’m a little surprised by the popularity of the platinum eagles. But then I started thinking about it from a price perspective…

When I first got involved in the precious metals industry, circa 2004, platinum cost twice as much as gold. Personally, I can’t help but look at platinum’s price and wonder, when’s the price going to go back up? Historically it’s been about 1.2x gold’s price… Maybe 43,000 other Americans are having the same thoughts?

Well, that’s just speculation. Let’s dive back into some real numbers that prove the U.S. Mint’s crazy Q1 isn’t an outlier…

Perth Mint had a great start to the year! They just reported a 68% increase in gold sales in March over February, shipping its products worldwide. It had sold 121,997 ounces of gold in March and 1,649,634 ounces of silver. Unfortunately, Perth Mint doesn’t publish sales records. Probably they’re afraid of competing mints, um, stealing their really great ideas?

Our Perth Mint top seller in gold is the affordable-for-many 10 gram bullion bar. Our #1 seller in silver is the adorable 2022 silver koala.

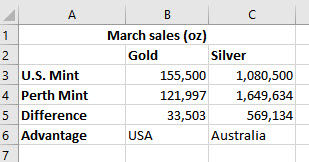

Since we don’t have official sales data, it’s interesting to contrast the volume of Perth Mint’s sales to America’s government mint…

Okay, what gives? Australia is the world’s #3 gold mining nation, producing 70% more ore than fourth-place America. So how could the U.S. sell more gold coins?

Well, we know from the pandemic panic that the U.S. Mint at least partially relies on Perth Mint-supplied gold coin blanks. By law, our mint has to buy American-mined gold first, but when that’s not available they buy from wherever they can. At a guess, I’d say Perth Mint makes more money selling blanks to the U.S. Mint than from minting their own coins? I have absolutely no data to back this up – just spitballing.

On the other hand, how in the world is Australia outselling the U.S. in silver coins last month? First, remember that over 8 million silver eagles flew out of the mint to find new homes so far this year. Five million of them sold in January. U.S. Mint was only able to produce 1.5 million in February, barely over a million in March.

Well, apparently, it's a supply thing. Bart Kitner, president of a rival retailer (call us next time!) had this to say: "If [the U.S. Mint] could produce more, they would."

Richard Weaver, president of the Accredited Precious Metals Dealers and the Professional Numismatists Guild, expanded on Kitner’s claim:

Bullion orders remain strong even with the lack of silver material available. Demand should remain steady for the balance of 2022, but Physical Metals could be the wildcard as we are seeing higher premiums and longer delivery times.

Isn’t that a kick in the pants? The U.S. Mint’s crazy Q1 could’ve been even crazier if they had a better silver supply! Well, where did we get silver before? (Quick googling…) Oh, right, the world’s #4 silver miner is no longer an option. Well, if we run out of silver eagles in a few weeks, don’t blame me!

I have my own theories, but you’ve heard them before. So let’s turn to Thorsten Polleit, chief economist at Degussa. Polleit thinks there are two huge reasons for these record gold and silver sales. First, buyers are coming to understand that inflation will become a recurring and worsening theme.

Second, the Russia-Ukraine war is threatening to further destabilize the Eurozone economies. (And oh yeah Russia is the world’s #3 gold mining nation, and #2 supplier of both platinum and palladium!) A disruption in the supply of gas and oil to the region would plunge it into an unprecedented recession. Well, presumably they’re going to want to buy some gold and silver just in case, too…

So we seem to be looking at two elements:

Well, that's a reliable recipe for higher prices! If only we were in the paper-gold market, we’d just write Real Actual Gold on a bajillion Post-It notes to meet demand. Alas! Both mints and dealers like BullionMax don’t work on promises. We fulfill customer demand in the truest physical sense. Here’s the problem: the U.S. Mint already can’t keep up with demand for silver eagles. People here in the U.S. and around the world are buying gold bullion faster than they have in decades. One of the world’s major precious metals miners is off the market for who knows how long? If this demand keeps up, we may yet see gold buyers band together and enforce the Basel agreement themselves.

Meantime, word to the wise: if you plan on buying gold or silver, or really any precious metals at all this year, start now. We don’t know how much longer our supplies will last, or how long the shelves will be empty before we can refill them. Buy now or cry later!

Paul Vanguard is a lifelong precious metals enthusiast and a proud member of the BullionMax team.