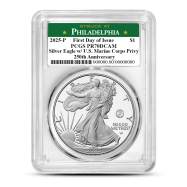

1-ounce silver coins stand out as the preferred choice among online silver buyers. Whether you delve into sovereign mint offerings or explore private mint collections, a 1-ounce silver coin invariably emerges as a prime option for investment or collection. Dive into our extensive selection of 1-ounce silver coins at BullionMax.

The enduring dominance of 1-ounce silver coins in the bullion market is undeniable, attracting investors for decades. Virtually every silver bullion coin collection features a 1-ounce counterpart, emphasizing its widespread appeal and accessibility. Notably affordable and easily stackable, 1-ounce silver proves itself as a savvy investment choice.

In short, nearly everyone does. The United States Mint, Royal Canadian Mint, Royal Mint, Austrian Mint, Bavarian State Mint, and the Perth Mint represent just a fraction of the prestigious sovereign mints regularly issuing 1-ounce silver coins. In addition to these esteemed entities, countless private mints worldwide contribute to the diverse landscape of 1-ounce silver coin production.

If you have any questions about one ounce silver coins, please feel free to ask. BullionMax customer service is available at 800-729-3202, online using our web chat, and via our email address.