Posted on November 27, 2021

Gold bullion products are some of the purest forms of gold available in the world. When it comes to gold bullion, investors can choose from bullion coins, rounds, and bars. Each of these options is useful in its own ways and has its pros and cons.

Ever wonder why precious metals and soup share a name? Turns out, the word bullion comes from Old French, meaning “to boil.” Whether you’re refining metal or making stew, boiling happens…

Gold bullion is “investment-grade” metal with a minimum of 99.5% purity. Unlike jewelry or most other metals, gold bullion is created for investors as well as for collectors. And because gold is a soft and easily malleable metal, it can take various forms, including coins, rounds, and bars.

Gold bullion products are made in the following steps:

Gold bullion can be refined into a variety of different forms, each of which has its benefits and drawbacks that investors should consider before buying. At the same time, it’s essential to understand that many precious metal options aren’t considered bullion, specifically numismatic coins, which are more generally collector’s items.

In essence: gold bullion’s value comes from its metal content alone. “Numismatic” coins may enjoy additional aftermarket value based on rarity, collectability, etc.

Gold bullion coins are struck by government-backed mints, also known as sovereign mints. As such, these bullion products are backed by the full faith of the government in which they are minted and usually employ the highest security and anti-counterfeiting measures. “Full faith and credit” in this case is typically represented by stamping a face value on the coin, for example, the $5 a 1/4 oz American gold eagle is “officially” worth. Even though the coin’s metal is worth much more, as far as the issuing government is concerned, it’s worth $5.

How different from the times when gold coins traded based on their metal content!

How different from the times when gold coins traded based on their metal content!

Gold coins date back to 700 BCE in ancient China and 600 BCE in the west, but the first modern gold bullion coin is the South African Krugerrand, first minted in 1967. The Krugerrand became so popular in the gold market that it accounted for 90% of all the world’s gold coin sales by 1980. Unlike most other coins, the Krugerrand has no face value. Instead, in South Africa, it’s accepted as legal tender based on the spot price of gold.

Gold coins are legal tender in the nation they are struck and have a face value (with a few exceptions) at the time of striking. The value of the gold content fluctuates, but the face value remains the same.

These coins are minted with intricate, often patriotic designs and have an intangible value that appeals to many. Therefore, they’re valuable for their gold content and as collectibles, too. Some collectible gold bullion coins might be difficult to value as their worth can exceed their melt value (or the coin’s value if it was to be melted down to its metallic contents and sold as scrap). However, it’s safest to assume that a bullion coin, like any precious metal, is worth its melt value. That’s the most conservative assumption.

Bullion coins often contain small amounts of other metals, which increase the coin’s hardness and reduce scratching.

Bullion coins most often come in sizes of 1 oz, 1/2 oz, 1/4 oz, and 1/10 oz. As for their market, bullion coins are highly liquid and available for purchase, making buying and selling coins extremely easy without compromising on price.

Pros:

Cons:

Popular examples:

A gold round has many similar characteristics to a gold coin, including its shape, size, and feel. But gold rounds differ in many important ways. Gold rounds are produced and struck by private mints, not government facilities. Therefore, they are not legal tender.

Still, rounds maintain their status as investment-grade gold bullion for investors. And because rounds can have their own intricate designs and symbolism, they may be produced as limited-edition works of art that could become collectors’ items. Rounds need not be designed by a committee. The designs they incorporate could be anything from a simple refiner’s logo to an elaborate engraving of a popular cartoon character.

The market for bullion rounds is slightly less liquid than bullion coins, making rounds not as easily tradable as gold bullion coins. When purchasing gold rounds, always ensure you examine the mint logo, weight, and purity markings directly on the rounds. These will help ensure your purchase is authentic.

Pros:

Cons:

Popular examples:

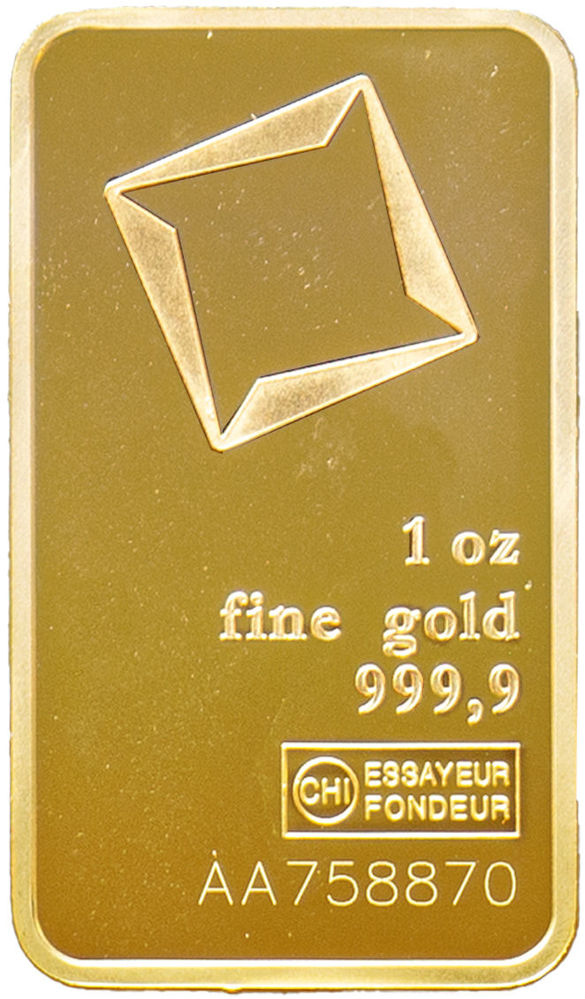

Gold bars are rectangular formed pieces of gold that derive their value from their gold bullion content. Gold bars were used as a form of currency dating back to the 7th century BC in Rome. Today, gold bars are strictly used as an investment vehicle and generally are viewed as having no collectible or sentimental value. These bars are often made by private mints, although some government mints produce bullion bars occasionally.

Gold bars are rectangular formed pieces of gold that derive their value from their gold bullion content. Gold bars were used as a form of currency dating back to the 7th century BC in Rome. Today, gold bars are strictly used as an investment vehicle and generally are viewed as having no collectible or sentimental value. These bars are often made by private mints, although some government mints produce bullion bars occasionally.

Bars are produced in various weights, most often from 1 g to 10 oz, although some mints strike gold bars that weigh up to 400 oz. Gold bars of 1 oz are by far the most common.

Of all gold bullion products, large gold bars will be the lowest priced as they have the lowest price premium compared to the spot price of gold.

Pros:

Cons:

Popular examples: