Posted on November 10, 2021

Allocating a portion of your portfolio to bullion is, for most people, an investment in safety and security. Bullion provides investors a haven from economic volatility and uncertainty while also providing upside potential, not to mention the beauty and appeal of majestic coinage and bars. There are many types of bullion in which you can invest, each with its benefits and appeal.

The term “gold standard” has been used over centuries because gold is the go-to precious metal for many investors. The first known gold artifacts came from the ancient Egyptians around 3,000 BCE. They used precious metals as a symbol of wealth and power.

The term “gold standard” has been used over centuries because gold is the go-to precious metal for many investors. The first known gold artifacts came from the ancient Egyptians around 3,000 BCE. They used precious metals as a symbol of wealth and power.

Per ounce, gold is an extremely valuable precious metal. Because of its high value, gold can be easily stored in less space than most other metals, which require more weight and volume for the same monetary value. The gold market is highly liquid with a wide array of investment options, making it easy to buy and sell gold bullion at any time.

Second only to gold, silver is the most well-known precious metal, and its history is just as long. The ancient Egyptians also used silver as money. At the time, the Egyptians discovered electrum — a naturally occurring alloy of gold and silver — and used a method of heating the alloy to extract the gold and silver separately.

The silver market is more volatile than its gold counterpart, leading to more significant economic gains for investors during bull markets. Its lustrous shine makes it a highly sought-after metal for collectors. There are also many choices of silver bullion products on the market. And while its low price per ounce makes it more accessible for all investors, keeping silver secure requires more storage space.

Platinum dates back to 700 BC, but most ancient civilizations saw platinum as an unwanted metal that got in the way of mining gold. The history of platinum changed in the 1700s when scientists began to find many uses for the metal with its high melting point and resistance to corrosion.

As a dense and easily malleable metal, platinum has many industrial uses, including catalytic converters, pacemakers, magnets, and even some drugs. Because of its many uses, platinum is a great option for diversifying precious metals holdings. Additionally, much like gold, its high value makes it easier to store than other metals.

The newest of all the widely-recognized precious metals, palladium, was discovered by chemist William Hyde Wollaston in 1802 when he was examining platinum from a South American mine. Wollaston was actually attempting to purify platinum at the time and instead stumbled upon an entirely new metal that came to have an important use more than one hundred years later.

As another industrial metal, palladium is used primarily in catalytic converters to filter out harmful gasses from automobile exhaust. The metal also has other uses in spark plugs, surgical instruments, and dentistry. Per ounce, palladium is currently the most valuable of the major precious metals, making it the easiest to store. However, the palladium market is not as liquid as other precious metals, making buying and selling the metals a bit more difficult.

| Precious Metal | Gold | Silver | Platinum | Palladium |

|---|---|---|---|---|

| Primary use(s) | Investment, jewelry | Investment, jewelry, silverware | Industrial, medical | Industrial, medical |

| Rarity | Extremely rare | Somewhat rare | Extremely rare | Rare |

| Melting Point | 1,948.24°F | 1,762°F | 3,222°F | 2,826°F |

| Boiling Point | 5,058°F | 3,925°F | 6,921°F | 5,367°F |

| Density (lbs per cubic inch) | 0.697 | 0.379 | 0.883 | 0.434 |

Bullion coins are struck from precious metals. But instead of being used as circulating coins in daily commerce, bullion coins are used as an investment or store-of-value for their owners.

Bullion coins are struck from precious metals. But instead of being used as circulating coins in daily commerce, bullion coins are used as an investment or store-of-value for their owners.

Bullion coins are produced by the official mints of nation-states like the United States Mint, the Royal Canadian Mint, and the South African Mint, to name a few. Only official national mints can manufacture bullion coins because they are legal tender where they are produced.

Benefits:

Popular bullion coins:

Unlike bullion coins, bullion rounds are not legal tender, meaning they lack a face value and denomination. As such, bullion rounds can be minted by private manufacturers who are free to design the precious metal in any way they please — as long as it does not break copyright law.

Benefits:

Popular bullion rounds:

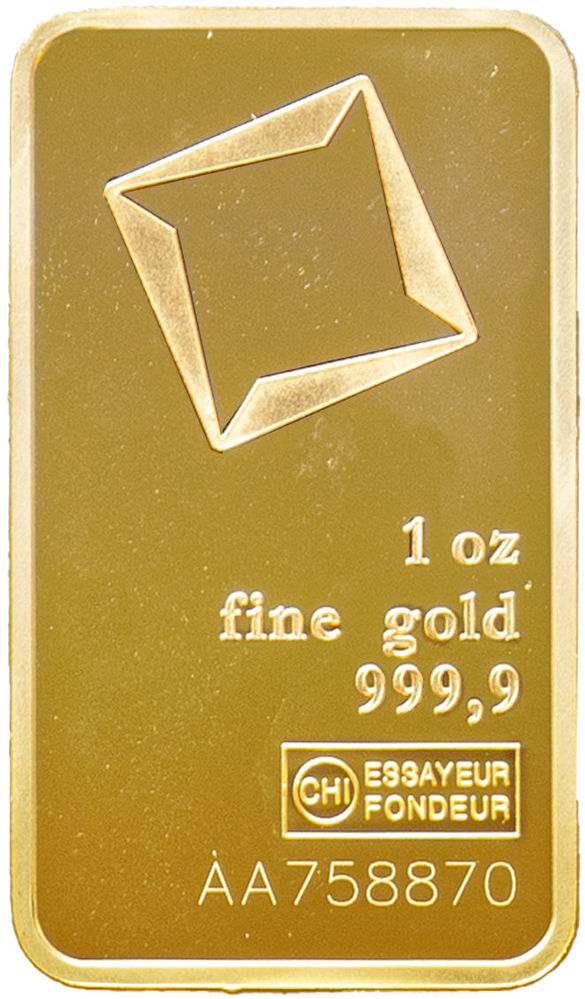

Not to be confused with an ingot, a bullion bar is a piece of metal cut into a thin rectangular shape. While some state-owned mints manufacture bullion bars, they are most often manufactured by private mints who stamp their logo and weight of the bar for identification and to verify authenticity. However, bars are not backed by the government and don’t have a legal tender like bullion coins.

Not to be confused with an ingot, a bullion bar is a piece of metal cut into a thin rectangular shape. While some state-owned mints manufacture bullion bars, they are most often manufactured by private mints who stamp their logo and weight of the bar for identification and to verify authenticity. However, bars are not backed by the government and don’t have a legal tender like bullion coins.

Benefits:

Popular bullion bars:

With four different bullion metals and three different ways to purchase them, there is a wide range of bullion options for investors. While gold and silver hold their value in their uses for jewelry and collectibles, both platinum and palladium have industrial uses that help them retain value.

Then there is the choice of the form of bullion to choose — coins, rounds, or bars. Coins have the added benefit of being government-backed and legal tender. They’re also beautiful works of art. Rounds are a cheaper option that is more affordable for investors, while bars have the lowest price premiums compared to other bullion options.

When you are looking to buy bullion, you should consider what appeals to you the most. Are you looking for a sleek design, the lowest price premiums, an easy-to-store and transport metal, or something else? This will help you determine which precious metal and bullion you should look into purchasing.

If you have any questions about bullion and precious metals, you can always contact the specialists at BullionMax, who can help you determine which bullion option is right for you.