There is a wide variety of gold coins available to investors and collectors today. Gold coin sizes typically range from 1/10 troy ounce to a full troy ounce, with gold purity usually between 99.9% to 99.99%.

With many mints and weights to choose from, it can be challenging to make a decision. Choosing a 1/2 ounce coin over a 1-ounce gold coin, for example, will depend on your budget, your risk tolerance, and the overall vision you have for your investment in physical, collectible gold coins.

An immediate benefit to 1/2 oz gold coins is that they are more affordable than their 1 oz counterparts. While a full-ounce coin can often provide slightly better value in terms of the spot price of gold, you’ll usually be able to buy almost twice the number of 1/2 oz gold coins as you would 1 oz coins for your money.

Owning 1/2 oz gold coins means you could have twice the diversity in your personal collection of coins. The value of different collectible gold coins fluctuates based on market demand and having a wider range of coins helps protect your investment from these fluctuations.

1/2 oz coins are also easier to store than larger sizes, taking up less space and being easier to transport. A 1/2 oz American eagle is about the size of a U.S. dollar coin, compared to a 1 oz eagle which is about the size of a U.S. half dollar. Ease of storage isn’t really an issue until your collection grows above “dozens” and into “hundreds.”

Finally, more coins mean a broader range of fascinating designs, histories and backstories from mints worldwide. Of course, this is all the more true for even smaller weight classes, such as 1/4 oz or 1/10 oz coins.

Investors often find that larger coins come at a better premium price than smaller coins, offering more value, and some buyers simply like the substantial feel of weightier coins in their hands. The beauty of having a wide selection of weights means you can create a bespoke investment plan based on the level of diversity, storage requirements, and premium needs you’ve outlined for your investment in gold.

On the other hand, you can also just buy whichever speaks to you most compellingly. That’s one of the differences between collectors and investors.

_1000.png) Mints all around the world create ½ oz gold coins. The 1/2 oz gold American eagle is probably the first coin that comes to mind for many investors, featuring the famous Lady Liberty design by Augustus Saint-Gaudens on the obverse side and boasting a purity of 0.999 fineness (99.9% pure gold). These coins have been issued by the U.S. Mint since 1986 and carry a face value of $25.

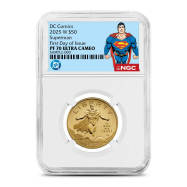

Mints all around the world create ½ oz gold coins. The 1/2 oz gold American eagle is probably the first coin that comes to mind for many investors, featuring the famous Lady Liberty design by Augustus Saint-Gaudens on the obverse side and boasting a purity of 0.999 fineness (99.9% pure gold). These coins have been issued by the U.S. Mint since 1986 and carry a face value of $25.

The 1/2 oz Britannia gold coins from the Royal Mint are equally sought after. With a face value of £50 and a gold content of 0.9999 or 99.99%, this coin is a longtime favorite among investors and collectors everywhere.

Face values and designs vary significantly between different 1/2 oz coins. Other examples include:

There’s no comparison to owning physical gold. Much of the world’s gold trading and monetary system, in general, is digitized, based on fractional reserve trading with very little in the way of underlying physical assets.

Ownership of physical gold coins protects investors from failures in banking or computer systems. Unlike digital money or paper-based gold, physical gold can’t be hacked or erased, and it acts as a hedge against inflation in the various, unbacked sovereign currencies the world runs on today. The global cash supply rose by unprecedented levels in 2021, causing many new investors to look to gold as a safe haven.

Physical gold coins are one of the safest and most trusted methods of storing value (just ask any central banker, or any pirate). Many gold coins are even eligible for tax-advantaged holding in a precious metals IRA. With the cultural and historical significance attached to the designs on the gold coins issued by mints worldwide, an investment in gold can be a fulfilling, liberating experience for many investors.

Need help or advice in purchasing 1/2 oz gold coins? Get in touch with BullionMax to get started with your gold purchase now.