Posted on November 10, 2021

Over the past several years, silver bullion has grown in demand and popularity. Thanks to its low price compared to other precious metals, silver bullion is accessible to all investors and, depending on the form, can make not only an excellent hedge against inflation but a great collectible item as well.

Silver bullion is high purity metal — above .999 pure — coveted by investors and collectors alike. In the modern world, silver bullion isn’t used in daily commerce. It is not to be confused with numismatic coins, which are valued based on their collectible value rather than the value of their metal content.

Silver bullion generally comes in three forms: coins, rounds, and bars.

Government mints (also known as sovereign mints) strike coinage from precious metals distributed as forms of currency and investment. Sovereign mints may strike circulating coins (our everyday pennies, nickels, dimes, and quarters in the U.S.) as well as collectibles and precious metal coins. Generally speaking, minted items with a face value come from government mints.

On the other hand, private mints are owned and operated by private companies that mint precious metals into silver bullion products. Anything purchased from a private mint is not backed by a government and does not have a face value.

In the precious metals industry, reputation is everything. Government mints have FAR more to lose than to gain by passing off second-rate products. Reputable, long-established private mints take as much care and attention to quality to safeguard their reputations. Some fly-by-night private mints pop up, sell substandard products, and disappear before the community can spread warnings about them.

Therefore, buyers should be careful to purchase silver bullion from reputable private dealers and refiners.

In its coin form, silver bullion is struck and distributed by national mints or other government entities that back each coin’s face value (although this face value is nearly always “nominal,” or absurdly small compared to the precious metal content – consider the 5 oz silver America the Beautiful coins with their face values of only $0.25). Silver bullion coins come in various weights, commonly 1 oz but can be as large as 5 oz.

In its coin form, silver bullion is struck and distributed by national mints or other government entities that back each coin’s face value (although this face value is nearly always “nominal,” or absurdly small compared to the precious metal content – consider the 5 oz silver America the Beautiful coins with their face values of only $0.25). Silver bullion coins come in various weights, commonly 1 oz but can be as large as 5 oz.

Because these coins are struck at government mints that invest the most in technology, they are the most secure and hardest to counterfeit. Thanks to government backing, silver bullion coins can be redeemed for their face value in their country of origin. Although we’re hard-pressed to think of a reason you’d want to do this.

Some silver bullion coins like the American silver eagle may become collectible items that appreciate aftermarket value. And because coin purchasers generally trust sovereign mints more than private mints, bullion coins are usually valued at a premium compared to other silver bullion products.

However, for the most part, silver bullion coins are bought and sold based on their precious metal content.

While they resemble coins, silver rounds are struck by private mints who create their own designs and mint marks. In essence, silver rounds are extremely pure pieces of silver bullion shaped like coins and struck by private mints.

Because the government doesn’t back private mints, silver rounds have no face value or government guarantee. Instead of sovereign mint markings, rounds may be adorned with the mint’s logo, appealing images, weight, and purity so that the buyer can verify this information.

Because the government doesn’t back private mints, silver rounds have no face value or government guarantee. Instead of sovereign mint markings, rounds may be adorned with the mint’s logo, appealing images, weight, and purity so that the buyer can verify this information.

The design of some rounds is as simple as a logo, weight, and purity. Other rounds are elaborate works of art, fascinating to behold. Private mints aren’t limited in their design choices. It’s not uncommon to see silver rounds featuring movie characters, cartoon characters, ancient deities, or even convincing replicas of official coinage (the 1 oz silver buffalo round is an example of this).

However, rounds from private mints usually don’t have the same anti-counterfeiting measures as sovereign mints and are therefore slightly easier to counterfeit. Generally speaking, the quality of silver rounds isn’t up to the same standards as government mints either.

Another difference is that rounds are generally priced much closer to their melt value, although still at a premium over the spot price of silver. Silver rounds are often sold on weight alone, with the seller fulfilling the customer’s order from whatever rounds happen to be in stock when the order arrives. Finally, the market for rounds is smaller than coins, making it slightly more challenging to buy and sell rounds when you need to.

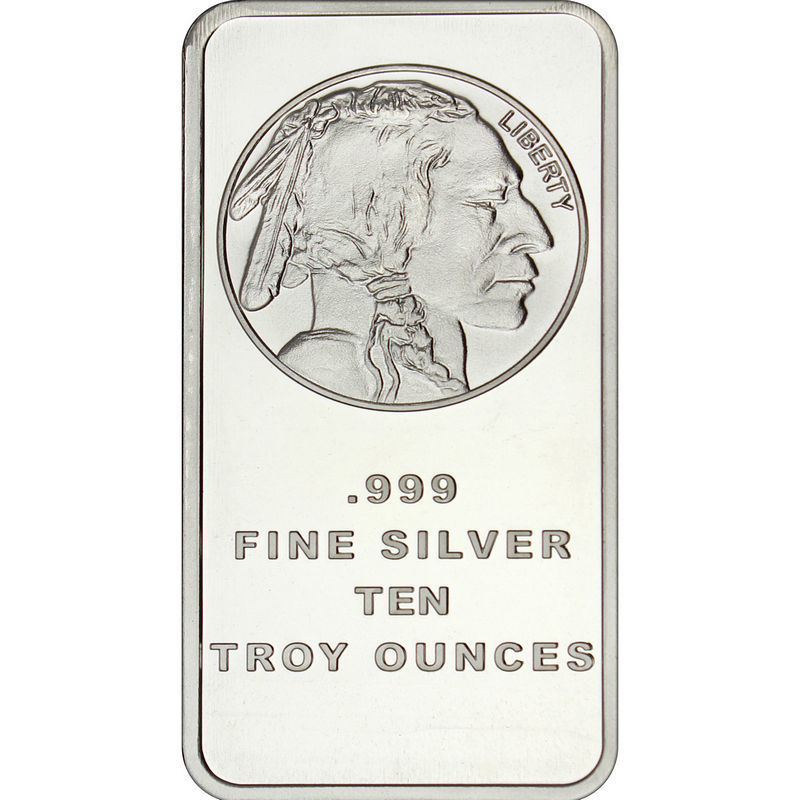

Silver bars are rectangular bullion products that are uniform in shape and of widely varying sizes. Out of all silver bullion products, bars trade at the closest to their melt value as they rarely have any collectible value outside of their metal content.

Silver bars are rectangular bullion products that are uniform in shape and of widely varying sizes. Out of all silver bullion products, bars trade at the closest to their melt value as they rarely have any collectible value outside of their metal content.

One of the biggest benefits to bars is their size and storage. Unlike coins and rounds, bars can be produced at enormous sizes like 100 oz. This makes storing wealth in silver bullion much easier. For instance, someone looking to purchase 1,000 oz worth of silver bullion could buy ten 100 oz silver bullion bars and likely pay a much lower premium over the spot price compared to ordering 1,000 one-ounce silver rounds. Plus, storing bars is easy since they are easily stackable and of a uniform shape.

Silver bars, especially those that are of larger sizes, are most often minted by private mints. Although, there are some sovereign mints, like the Royal Canadian Mint, which strike silver bullion bars as well.

| Criteria | What is it? | Best option | Secondary option |

|---|---|---|---|

| Availability | How readily available the product is to buy and sell | Coins | Rounds, Bars |

| Value over spot price | The value of the product compared to the spot price of silver | Coins | Rounds, Bars |

| Counterfeit risk | How easy is the metal to counterfeit | Coins | Rounds, Bars |

| Storage | How easy the metal is to store | Bars | Coins, Rounds |